I plan to work for an international organization’s Vietnam-based office from August 2018 and will need a car to drive to the office. Can I bring the car I am using in my country to Vietnam for use or should I buy an imported brand-new car? Will I be entitled to tax exemption or reduction for the car?

According to Vietnamese law (Prime Minister Decision 10/2018/QD-TTg), as from April 20, 2018, the following persons may temporarily import a car or motorcycle without having to pay import duty, excise tax and value-added tax:

- Diplomats of diplomatic missions, consular officers of consulates, employees of representative offices of international organizations based in Vietnam who enjoy privileges and immunities under treaties to which Vietnam is a contracting party or has acceded;

- Administrative or technical staff members of diplomatic missions or consular offices who enjoy privileges and immunities on the basis of reciprocity between the Vietnamese State and their appointing states; employees of Vietnam-based representative offices of international organizations who enjoy privileges and immunities under treaties to which Vietnam is a contracting party or has acceded.

When you come to work in Vietnam as one of the above subjects, you may temporarily import one car without having to pay import duty, excise tax and value-added tax if satisfying the following conditions:

|

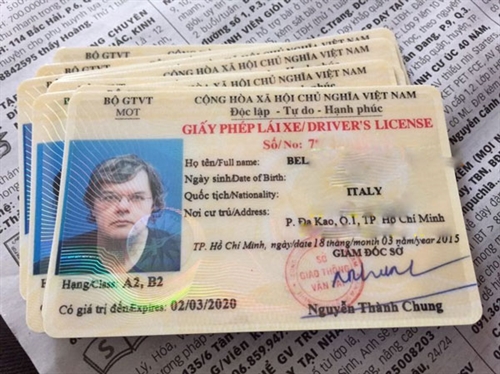

| A diplomatic car __Photo: Internet |

- Being granted by the Ministry of Foreign Affairs the temporary import quota in a book of duty-free import quotas. If you is a successor wishing to temporarily import a car or motorcycle, the Ministry of Foreign Affairs will only grant the temporary import quota when your predecessor has completed the procedures for re-export or disposal of his/her car or motorcycle or transferred it under regulations after receiving a notice from the customs;

- Having a remaining working period of at least twelve months in Vietnam out of the total period of at least eighty months from the date of being granted an identity card by the Ministry of Foreign Affairs, as stated in such identity card;

- Having a remaining working period of at least nine months in Vietnam out of the total period of at least twelve months from the date of being granted an identity card by the Ministry of Foreign Affairs, as stated in such identity card.

Should your car be irreparably damaged due to an accident, a natural disaster or another objective technical reason during your working period in Vietnam and you still have to work in Vietnam for at least nine months (as stated in your identity card granted by the Ministry of Foreign Affairs), you may temporarily import free of duty another car to replace the damaged one after completing the procedures for re-export or disposal thereof.

If you wish to drive your current car in Vietnam, it may be permitted to be temporarily imported as a personal effect. However, such car must have been used in your country for five years or less (by the year of import) counting from the year of manufacture and its importation must comply with the provisions on import of used cars of Decree 187 of 2013 detailing the implementation of the Commercial Law regarding international goods purchase and sale and goods purchase and sale agency, processing and transit activities with foreign countries, and relevant guiding documents.

When carrying out the procedures for getting a permit for temporary import of a car, you have to submit to the customs office documents to prove your car ownership, such as document proving the via-bank payment for the car purchase (for temporarily imported cars) or circulation registration or deregistration paper (for cars temporarily imported as personal effects).- (VLLF)