Central bank digital currency (CBDC) is a new issue of interest of most central banks and economists and lawmakers in the world. In short, CBDC is a generic term for a version of currency that could use an electronic record or digital token to represent the digital form of a nation’s currency. CBDC is issued and managed directly by the central bank and could be circulated like a traditional currency. This article discusses CBDC’s economic and legal aspects, including CBDC technologies, its advantages and downsides and possible legal reforms for issuance of CBDC.

Prof. Dr. Andreas Stoffers[1] and Doan Thanh Huyen[2]

Introduction

“One ring to rule them all, one ring to find them, one ring to bring them all, and in the darkness bind them in the Land of Mordor where the shadows lie.” - John R.R. Tolkien “Lord of the Rings” (1954/55)

This quote from the world-famous fantasy epic “Lord of the Rings” may come to some critics of a central bank digital currency (CBDC) when they think of the great power that would accrue to the central bank if it were to gain control over all payment flows of all citizens as a monopolist. It is no secret that many central banks around the world are currently working on the CBDC issue, or at least keeping an eye on it. Many mainstream economists praise such a digital central bank money as innovative and profitable for the economy and society. Others see the danger that the centralized control can bring. In this article, special attention is paid to the economic, social and legal implications of the CBDC. For a better understanding, the blockchain technology will be briefly discussed first.

Blockchain technology, cryptocurrency and CBDC

Blockchain technology has the ingredients to be a real game-changer. The upheavals it brings with it have a disruptive character for many areas of business, industry and society. To explain, blockchains are fraud-proof, distributed data structures in which transactions are logged in chronological order, traceable, unchangeable and without a central authority. With blockchain technology, ownership relationships can be secured and regulated more directly and efficiently than before, since a complete and unchangeable data record creates the basis for this. The areas of application are diverse and range from decentralized currencies such as Bitcoin to stock trading and logistics. They include smart contracts and transactions. It is not just about pure payment flows, but ultimately about the creation of digitalized forms of representation of rights as well as tangible and intangible assets within the framework of “distributed ledger technology” (DLT). In a sense, it is a “tokenization” of these goods and services[3]. This tokenization increases liquidity and facilitates the fractionalization of assets. Assets that are actually illiquid, such as real estate, works of art or antiques, can be divided up and traded on secondary markets. Transactions become easier and faster, in some cases even made possible by tokenization. Another major advantage is the decentralization and automation of transactions[4].

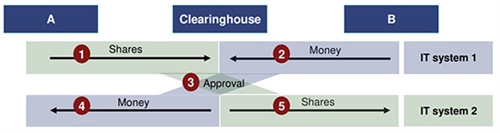

An example from stock trading. Currently, a transfer of ownership in the Euro zone takes about two or three days. The share changes from the owner’s custodian bank to the new owner’s custodian bank using a clearing house. In a second IT system, the money is shifted from the buyer again via a clearing house, which confirms the transfer, to the seller. The use of two IT systems, the duration and the costs are clear disadvantages here. These are eliminated in blockchain technology based on a DLT system. (See Table 1)

In the logistics sector, it is comparable. Blockchain technology can be used to ensure that as soon as goods exported from China to the EU, for example, reach an agreed point and the QR code is scanned, the money (or the agreed partial amount) lands on the exporter’s account in milliseconds. Also conceivable is direct, smart-contract-based payment from machine to machine, for example when an autonomously driving car pulls into a parking space.

For most of these applications, some forms of digital money are needed. Although a decentralized cryptocurrency such as Bitcoin is also conceivable in principle, most central banks are unlikely to want to let the reins be taken out of their hands here. In addition, a linking of the currency systems is necessary. This is where the CBDC comes into play. However, not all CBDCs will be based on blockchain technology, but on a DLT system. Blockchain is only one viable option.

Traditionally central bank money takes two forms, which are cash and reserves held by eligible financial institutions at the central bank. CBDC is a generic term for a third version of currency that could use an electronic record or digital token to represent the digital form of a nation’s currency. CBDC is issued and managed directly by the central bank and could be used for a variety of purposes by individuals, businesses, and financial institutions[6]. This makes CBDC to be clearly distinguished from non-governmental currencies such as Bitcoin, Ethereum or Ripple, which are also based on blockchain technology.

CBDC in the global context

On 14 July, 2021, the Governing Council of the European Central Bank (ECB) decided to launch the investigation phase of digital Euro project after nine months ECB published its report on digital Euro as the safest form of money[7]. The investigation phase is planned to last 24 months and expected to address key issues regarding digital Euro design and distribution[8]. It is desired that a digital Euro will meet the needs of Europeans while helping prevent illicit activities and avoid any undesirable impact on financial stability and monetary policy[9]. Of course, the investigation will not prejudge any future decision on the possible issuance of a digital Euro, which will come only later. ECB stated that, in any event, a digital Euro would complement cash, not replace it[10].

To date, the US, the world largest economy[11], has not decided whether or not to issue a CBDC in the US payment system. However, given the dollar’s important role globally, the US Federal Reserve has been engaged in CBDC research and policy development including the underlying technologies and legal consequences and policy issued associated with a CBDC[12].

Meanwhile China, the second largest economy in the world[13], has been testing the e-Yuan in practice in four major cities since April 2020. Next year, China will start a broad roll-out. China is, according to experts, two or three years ahead of other nations in the development and testing of the CBDC. The study “Crypto RMB: Finance Innovation or New Tool for Control? - China’s New Digital Currency and What it Means to the World”, published by the Friedrich Naumann Foundation in May 2020, describes precisely this development and lists scenarios. Thanks to the already existing infrastructure and the multitude of Chinese tourism and business activities, especially in Europe and Asia, there is already a basis on which business partners, hotels and traders in the destination countries could be forced, through gentle or less gentle pressure, to do business on the basis of the e-Yuan. Some countries would certainly not be able to withstand this pressure. Other countries are likely to follow. Payment platforms like Alipay (Lazada is already owned by China) could gain further influence[14].

In other parts of the world, Sweden and Ukraine are piloting E-knora and E-hryvnia respectively[15]. Similarly, the Bahamas is piloting the Sand Dollar while Lithuania is trying with LBCoin. In the future, it is predicted that there will be more and more CBDC pioneers and subsequently the impact of CBDC on the global economy would be assessed based on more concrete evidence.

Advantages and downsides of CBDC

Advantages

There is a fact that banknotes and coins are counterfeited popularly. According to the Deutsche Bundesbank, in the first half of 2020, approximately 34,000 counterfeit Euro banknotes with a nominal value of €1.6 million were recorded and this means that the number of counterfeits rose by 24 percent compared with the second half of 2019[16]. CBDC is digitally issued in the form of a central bank’s liability. Some central banks intend to structure CBDC in a manner that digitalizes balances in cash current accounts in the books of the central bank while others are exploring the design of CBDC in the form of a digital token, not connected to an account relationship between the central bank and the holder[17]. Subsequently, CBDC as a currency unit is issued and effectively controlled by the central bank and, thus, hard to be counterfeited. As CBDC system enables a central bank to effectively control the circulation of CBDC, the system also ensures that high-value transactions are easily noticed for anti-money laundering

checks[18].

For the state and the administration, a CBDC means a significant increase in efficiency in tax collection. Everything will be much more transparent. Corruption and other irregularities can be effectively prevented. Especially in the area of real estate speculation, which has fuelled the real estate fever in Vietnam, it will be clearer about where the financial flows come from. Straw-man transactions can be more clearly identified and handled.

It is obvious that costs and expenses to maintain a cash money system are high for some reasons. Firstly, issuance of banknotes and coins is a costly work[19]. Secondly, a large number of countries practice in government cash management involving both the central bank and the state treasury[20]. They are, in fact, cumbersome apparatus with a lot of manpower. CBDC could reduce costs by “printing” banknotes digitally and maintain a unified payment system controlled by the central bank.

With CBDC, central banks have to develop and maintain their centralized systems that enable them to control the issuance and circulation of CBDC and decrease the involvements of intermediate parties that are now holding the payment systems. In other words, CBDC may be regarded as a means to enhance the control and efficiency of centralized payment systems[21]. In addition, a CBDC holder, without having to have a bank account at a specific bank, may use his money in various ways. Firstly, for account-based CBDC, the identity of the account holder allows him to access the money[22]. Secondly, for digital token-based CBDC, the knowledge of a password allows the holder to dispose the money[23]. Additionally, CBDC may bring about a financial inclusion by providing safe and liquid government-backed means of payment to the public[24] while making the financial system safer.

As reported in many CBDC pilots, central banks issue digital tokens using DLT. Agents in the systems use CBDC to make interbank transfers that are validated and settled on the DLT system[25]. Thus, it is true that CBDC also support the application of DLT to issue and manage the circulation of tokenized digital government-backed money.

Downsides

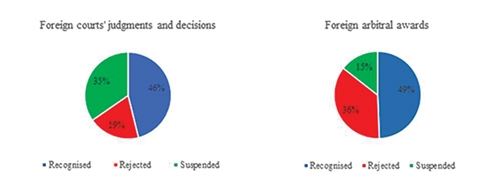

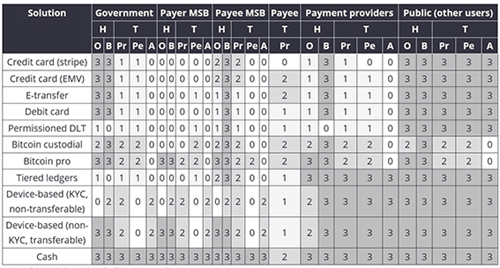

Indeed, a digital currency gives a government unimaginable possibilities to control all payment flows and also gives rise to the question of privacy protection while the government can know every single transaction of a citizen in his normal life. (See Table 2)

Note: Higher/darker values indicate more privacy.

In Table 2, H stands for holding; T for transaction; O for owner; B for balance; Pr for payer, Pe for payee, and A for amount. Privacy is the degree to which holdings and transactions data are hidden from participating entities. The entities are many - the payer’s bank or money services business (MSB), the payee’s MSB, the government, and the public (other users).

In any case, issues of confidentiality of personal data, cyber security and prevention of fraud must also be considered. An appropriate legal framework has to be created for this purpose. In any case, needs and legal requirements of other countries must also be taken into account. As an example, the strict Foreign Account Tax Compliance Act (FATCA) of the US should be mentioned here, which places special requirements on the identification of customers and holds out the prospect of sanctions in the event of non-compliance. Moreover, once there is a CBDC, negative interest rates can be enforced, as citizens no longer have the option of hoarding cash. It is also likely to be problematic for the commercial banks: Who needs a bank branch when they have their money in a central bank account? It is true that the central bank could continue to allow commercial banks to show the accounts for central bank money on their own balance sheets. But since digital central bank money is safe and payments via smartphone or computer are very easy, the central bank is likely to quickly take share away from the commercial banks. After all, why would a customer still need a commercial bank? In the credit sector, too, the central bank may be tempted to issue cheap loans directly to companies and thus exert greater control. If commercial banks falter, the central bank can quickly act as a saviour and ultimately nationalize them. All in all, times are likely to be tough for commercial banks, whether they have a CBDC or not.[27]

But these are developments, or rather undesirable developments, that do not have to happen this way. This makes it all the more important for countries like Vietnam to prepare and be prudent in the introduction and use of digital money. For the two authors of this article, it is an essential point of their research.

Possible legal reforms in preparation for issuance of CBDCs

As discussed above and quoted by IMF, many central banks have started in-depth discussions on the appropriateness and feasibility of issuing CBDCs[28]. Because the new form of CBDC results in various legal consequences, it raises important legal questions to both central banks and policymakers around the world. As the central bank plays an important role and is the heart of currency issuance and circulation in an economy, many countries have developed their central bank laws and monetary laws to govern those issues. For a monetary union like the Eurozone, the issuance of the Euro as a common currency of some members of the European Community is exercised on a treaty-based foundation[29]. This Section addresses the need of a central bank and monetary law reform in preparation for CBDCs.

Central bank law

Many countries have developed their central bank laws to govern functions, powers and activities of their central banks while the currency is normally provided in a general provision in the Constitution or included in numerous provisions of central bank laws.

The key concept to determine whether or not a central bank could issue CBDCs is its “mandate”. For more details, to ascertain whether a central bank is allowed to issue CBDCs or not, its mandates should be looked at to see whether or not the law explicitly or implicitly authorizes the central bank to do so. Mandates of a central bank are established under the principle of attribution of power where a public entity may only conduct activities within the mandates allocated to it under the law.

As actions of a central bank beyond its mandates are vulnerable to political and legal challenges[30], many countries have developed their central bank laws that provide mandates of central banks in a very detailed fashion and central banks usually are not allowed to take any actions that are not attributed to it under the law. For example, Sweden, a country which has its central bank founded in 1668 as the oldest central bank in the world[31], follows the principle of power attribution. The Swedish Central Bank Act requires that its central bank “may only conduct or participate in such activities for which it has been authorized by Swedish law”[32].

Recognizing that a central bank would have a traditional main function i.e., currency issuance, central bank laws, adhering to the principle of attribution of power, provide details of such functions and empower central banks to carry out their functions. Most central bank laws in the world only authorize central banks to issue cash currency i.e. banknotes and coins and are silent about whether or not CBDC issuance is under the power of the central banks[33].

Look at Germany, the largest economy in Europe[34], as an example. Germany has the Deutsche Bundesbank in Frankfurt am Main as the central bank of the country[35]. The bank is “a federal institution with legal personality under public law” with “a capital amounting to 2.5 billion Euro, is owned by the Federal Republic of Germany”[36]. The functions of the Bundesbank are provided explicitly under the German law. Accordingly, the Bundesbank has the sole right to issue banknotes in the territory of Germany and banknotes denominated in Euro is the sole unrestricted legal tender[37]. The bank also announces publicly the denominations and distinguishing features of the banknotes it issues[38].

Similarly, the Central Bank of Jordan is given a function “to issue banknotes and coins in the Kingdom”[39]. The Dutch Central Bank’s functions include “to provide for the circulation of money as far as it consists of banknotes”[40]. It is obvious that for those countries whose laws limit currency issuance in cash by central banks, if they wish to issue and circulate CBDCs, it raises a need for a reform of the central bank law to empower central banks to issue currency in a form other than cash.

In some specific cases, central bank laws of a few countries give a broader wording text that authorizes central banks to issue “currency” in general without limitation to banknotes and coins. The National Bank of Ukraine Law, for example, provides that the central bank has the function of “solely issuing the domestic currency of Ukraine and to organize its circulation”[41]. Similarly, the Central Bank of Nigeria is empowered to “issue legal tender currency in Nigeria”[42] and the People’s Bank of China is empowered to issue the currency and administer its circulation[43].

For countries whose central banks enjoy broad ancillary functions in currency issuance and circulation, it may not be necessary for a significant central bank law reform to mandate central banks to issue CBDCs. However, in both cases, as CBDCs are circulated in a payment system different from the traditional system, which is applying now, countries should also care about developing new rules governing banking professional activities related to CBDCs.

Monetary law reform

Every sovereign State has the right to determine and establish its own currency system. In the case of a monetary union, this sovereign power may be ceded to the union in which this power is exercised collectively by the union on behalf of the member states. The European Union, where some state members share the common currency Euro, is the typical example of a monetary union.

Monetary provisions may be integrated in the central bank laws or, in many jurisdictions, in the constitutions. Monetary laws basically govern two issues: (i) the official monetary unit of the country or the monetary union and how the money value is determined; and (ii) the official means of payment of the country or the monetary union.

With regard to CBDCs, the fundamental questions include whether or not CBDC is a new official monetary unit or a new official means of payment and what CBDC’s essential monetary law attributes?

Monetary law also establishes which means of payment are officially sanctioned by the State or the monetary union. Almost all States and monetary unions legally and officially sanction one or more types of means of payment. In additions to cash currency as a traditional means of payment, the use of commercial bank book money is generally accepted in many countries. Commercial bank book money is a claim to receive officially issued banknotes and coins. CBDC should be considered as a means of payment like banknotes, coins or bank book money for the following reasons: (i) upon a CBDC issuance by a State, the CBDC is legal and valid currency and accepted to circulate in the State’s territory; and (ii) the CBDC is backed by a government and corresponded to assets of the central bank of the State. In nature, the CBDC has all characteristics of a legal tender that enables a debtor to discharge his obligations to a creditor by tendering CBDC to the creditor. The issuance and circulation of CBDC and use of it as a means of payment may challenge current legal frameworks of many countries since most monetary laws were developed based on the approach of cash currency and bank book money. As discussed above, many monetary provisions and practices are in pursuance to constitutions and central bank laws. For example, the Australian Constitution requires that the Australian Parliament shall have the power to make laws for the peace, order and good government of the Commonwealth with respect to inter alia, “xii. Currency, coinage and legal tender”[44]. The Swiss Constitution also stipulates “the Confederation is responsible for money and currency”. A third example is the Bank of Japan Act which provides “the purpose of the Bank of Japan, or the central bank of Japan, is to issue banknotes and to carry out currency and monetary control”[45]. Because of this, central bank law and monetary law reforms in preparation for CBDC issuance and circulation should be taken in conjunction with each other.

A vision for Vietnam

China has already distributed some 200 million digital Yuan (approximately USD 30.7 million) as part of a pilot project across the country in four cities, namely Shenzhen, Suzhou, Chengdu and the Xiongan zone near Beijing[46]. It is predicted that the pilot project will end soon, leading to nationwide mass issuance of digital currency. The mass issuance of digital Yuan will probably affect the world’s economy as the Chinese currency was added to the IMF’s basket of major reserve currencies in October 2016[47].

China is also the second largest export market of Vietnam[48]. In 2020, the total value of exports from Vietnam to China reached USD 48.9 billion[49]. Therefore, the influence of digital Yuan in the future to Vietnam’s economy, once it is widely used, can be foreseen. An appropriate preparation can help Vietnam properly respond in various circumstances.

A thorough research on influence of CBDC including digital Yuan to Vietnam’s economy and how to react in the event that import of materials and goods from China switches to payment in digital Yuan is strongly recommended.

There should be a long vision for the country to issue a digital Vietnam Dong[50] when CBDC becomes popular in the world economy. Of course, when and how the issuance should be depend on specific conditions of the country. The current legal framework of Vietnam provides that the State Bank of Vietnam [i.e. the central bank of Vietnam] is the only agency in the country issuing banknotes and metal coins of the Socialist Republic of Vietnam and responsible for ensuring the sufficiency of banknotes and coins for the economy[51]. As discussed above, to prepare for the issuance of digital Vietnam Dong, the country should carry out legal reforms to broaden the mandate of its State Bank to digital currency issuance and circulation and recognize the digital form of the official currency and to establish legal provisions and standards for professional issuance and circulation of digital currency and use of it as a means of payment in the economy.

Conclusion

CBDC is a new issue and will be definitely a development trend that almost central banks in the world have to consider. In addition to advantages like cost efficiency, safer and transparent payment system and administrative convenience, CBDC brings a number of downsides of which the protection of personal privacy is the most concerned. The blooming of CBDC will take place in the near future and countries should carry out necessary preparations for it, including considering application of new technologies and implementing necessary regulatory reforms.-

See also Garratt, Rod and Lee, Michael and Malone, Brendan Malone and Martin, Antoin: Token- or Account-Based? A Digital Currency Can Be Both, Liberty Street Economics, Federal Reserve bank of New York (August 12, 2020) https://libertystreeteconomics.newyorkfed.org/2020/08/token-or-account-based-a-digital-currency-can-be-both.html (accessed on June 23, 2021).