Deputy Prime Minister Le Minh Khai expressed concern over the slow progress in the disbursement of public investment capital and urged ministries and agencies to identify the causes of delays and find urgent solutions.

He was speaking at a meeting with the working group No. 1 on promoting the disbursement of public investment capital on April 13.

|

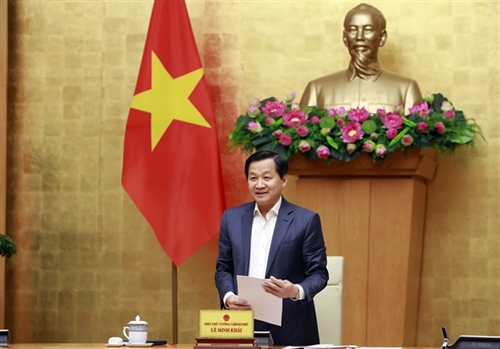

| Deputy Prime Minister Le Minh Khai delivers a speech at the meeting with working group No.1 on promoting disbursement of public investment capital__Photo: VNA |

Reports from the Ministry of Planning and Investment showed that the total State budget investment plan for 2023 assigned by the Prime Minister to 17 ministries and central agencies under the working group No. 1 was over VND 38.3 trillion (USD 1.63 billion).

While 91.2 percent of this plan has been allocated, only 0.04 percent has been disbursed so far. This disbursement rate is significantly lower than the national average of 10.35 percent. Furthermore, 13 ministries and central agencies have yet to disburse any funds at all, while the remaining four have disbursed less than 2 percent of the assigned plan.

The low disbursement rate was caused by insufficient organization and implementation of investment procedures for projects, which did not comply with the Law on Public Investment and the direction of the Government and the Prime Minister.

The ministries of Finance and Planning and Investment were assigned to perform tasks and projects under the socio-economic recovery and development programs, but they have not completed procedures to deliver the annual plan.

Permanent Deputy Governor of the State Bank of Vietnam Dao Minh Tu said more than 9 percent of the capital worth VND 318 billion allocated for the basic construction works of the central bank has been disbursed, exceeding the plan in the first quarter of this year.

However, the disbursement of the remaining capital worth VND 23.9 trillion for the socio-economic recovery and development programs has been slow due to unclear and abstract criteria for assessing the "eligibility" of businesses and commercial banks.

This money was included in the support package of VND 40 trillion with 2 percent interest rate annually for businesses and cooperatives that have demonstrated high eligibility after the COVID-19 pandemic.

As stipulated in the Resolution 43/2022/QH15, commercial banks and businesses must ensure their eligibility to the preferential policy, but such provisions were unclear and abstract, he said.

This has led to hesitancy to implement the program, as many fear potential audit issues and difficulties in requesting arrears.

Addressing the issue, Deputy PM Khai acknowledged the challenges in implementing the support package of VNĐ40 trillion and emphasized the need for strict procedures as this involves State budget funds.

He urged the central bank to continue directing disbursement towards supporting businesses and people, and to clarify which policies would replace the support package if switched to another program.

He also emphasized the importance of implementing the directives and resolutions related to public investment disbursement that have been issued by the Government and Prime Minister.