|

| Assembly line for semiconductor wafer transfer robots at TAZMO Vietnam Co. Ltd., Long Hau Industrial Park, Tay Ninh province__Photo: Thanh Phuong/VNA |

With 51 articles arranged in six chapters, the Law on Digital Technology Industry (the Law) marks a historic milestone in Vietnam’s digital transformation, paving the way for the country to create breakthroughs in the digital era.

As the first nation in the world to enact a law on digital technology industry, Vietnam affirms its determination to build a proactive legal framework, foster the robust growth of domestic technology enterprises, promote deeper international integration, and position itself more firmly in the global technology value chain.

By concretizing Politburo Resolutions 57-NQ/TW, 59-NQ/TW, 66-NQ/TW, and 68-NQ/TW, the Law puts forth measures to transform the digital technology industry into a major driver of the national economy, with its growth rate projected at two to three times faster than GDP.

Developing Vietnamese digital technology products

With the goal of increasing the share of domestically manufactured digital technology products, the Law provides a wide range of support policies.

Foreign-invested enterprises that transfer technology and partner with Vietnamese firms will be entitled to corporate income tax incentives. Meanwhile, local startups will receive support covering up to half costs of acquiring advanced technologies and developing prototypes, thereby heightening their capacity to manufacture products designed and developed in Vietnam.

Vietnamese digital technology products will be prioritized in state-funded projects. Research and development (R&D) activities will enjoy corporate income tax exemption and financial support to build advanced research infrastructure facilities. These measures aim to foster innovation, ensuring Vietnamese products not only to meet domestic demand but also to compete effectively in the international markets.

The Law also provides clear mechanisms to help Vietnamese technology firms penetrate into international markets and build global brands.

Large-scale investment projects will receive prolonged corporate income tax breaks, financial support from the Development Investment Fund, and import duty exemption or reduction for hi-tech equipment. Notably, the Government will establish a network of Vietnamese digital technology representatives in the important international markets, combined with global cooperation programs, in order to support Vietnamese enterprises in their gradual transformation into multinational corporations capable of competing on par with leading tech giants in the world.

Mastering core and strategic digital technologies

Under the Law, the State will place orders with enterprises to develop artificial intelligence (AI), big data, and blockchain technologies. State budget funds will be allocated for R&D infrastructure, enabling businesses and research institutes to develop core technologies.

For the first time, semiconductors, AI and digital assets are brought into law.

Semiconductor projects will receive targeted incentives and support across all stages, from R&D and auxiliary and chip production to electronic device assembly. Enterprises will be allowed to import used technological lines, equipment, machinery and tools for direct use in the manufacturing of semiconductor chips. They will also receive massive financial support to facilitate mastery of technologies.

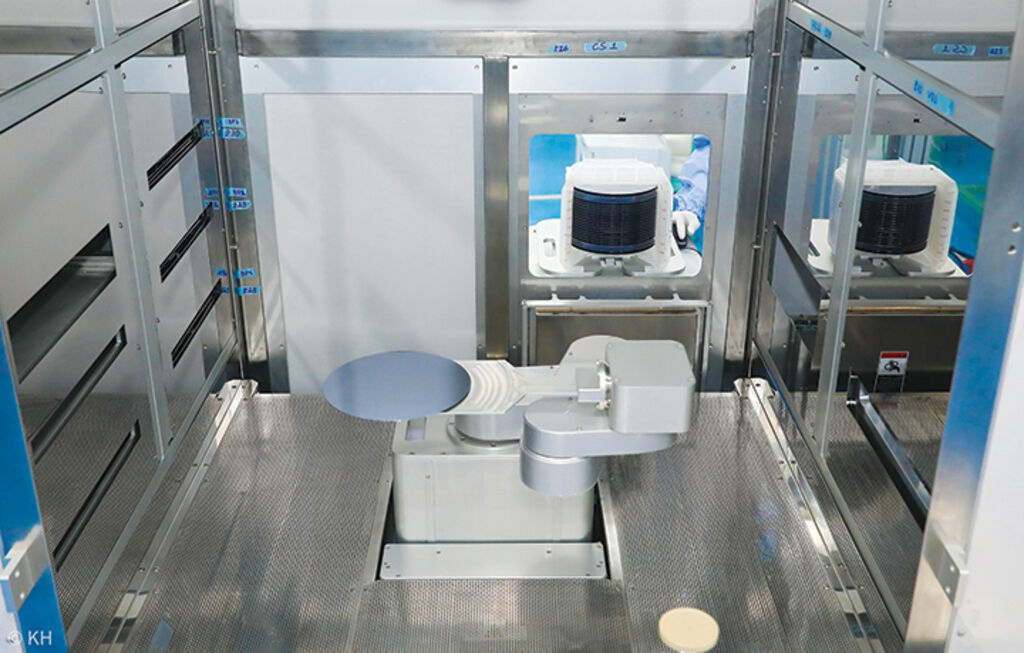

|

| A stage in semiconductor chip production at TAZMO Vietnam Co. Ltd., Long Hau Industrial Park, Tay Ninh province__Photo: Thanh Phuong/VNA |

AI-related regulations are also introduced on the principles of putting people at the center, ensuring transparency, safety and non-discrimination. AI systems will be classified by risk level, with high-risk systems subject to strict technical requirements and close supervision. All AI products will be required to carry clear identifications, while developers and users will be held accountable for data protection and cybersecurity. The State will prioritize investment in AI research, build AI data centers, and give tax and financial incentives to enterprises to accelerate innovation.

Digital assets, including encrypted and virtual assets, are classified according to their intended use and underlying technology. The Government is tasked to issue detailed regulations to ensure flexibility and alignment with international standards.

Fostering digital technology enterprises and developing high-quality human resources

To build a resilient digital technology ecosystem, including supply chains and supporting industries, the Law introduces comprehensive support policies aimed at having 150,000 digital technology enterprises nationwide by 2035.

Large-sized enterprises are encouraged to scale up through investment incentives and strategic digital technology procurement programs, while smaller supporting firms will benefit from financial support, tax relief, and preferential access to digital supply chains. Collaboration between large and small businesses is further promoted through technology transfer, ensuring a fully integrated ecosystem from production to consumption.

Small- and medium-sized enterprises will be provided with support in infrastructure construction and workforce training, and given priority in bidding for public projects. State budget funds will also be channeled into special projects and technology innovation, thereby enabling enterprises to improve their creativity and competitiveness. Digital technology parks, backed by preferential policies, will help create a favorable environment for entrepreneurship and sustainable development.

Recognizing human resources as the cornerstone of digital industry development, the Law sets forth policies to nurture talents.

High-quality digital technology professionals are exempt from personal income tax for their first five years of working in Vietnam while foreign experts are granted five-year visas and exempted from work permits.

The State will provide funds for training and upskilling digital technology workforce through national programs in collaboration with businesses and educational institutions. These programs focus on advanced technology skills, project management and innovation to meet global market demands. The Law also introduces special incentives regarding wages, workplace conditions and research support.

One of the Law’s highlights is the flexible personnel rotation mechanism that allows civil servants and public employees to be seconded to digital technology enterprises while retaining their salaries, allowances and official positions. When returning to state agencies, they will receive priority, with their experience recognized, and in some cases, toward future leadership appointment.

The Law will come into force on January 1 next year.- (VLLF)