Vietnam needs a list of potential and trustful private-public partnership (PPP) projects in order to attract more foreign investment capital in those projects and cope with financial challenges, said ADB country director in Vietnam Eric Sidgwick.

He added Vietnam’s infrastructure capital demand was estimated at 10-12 percent of its GDP for the 2015-2020 period, many times higher than the state budget’s capability.

|

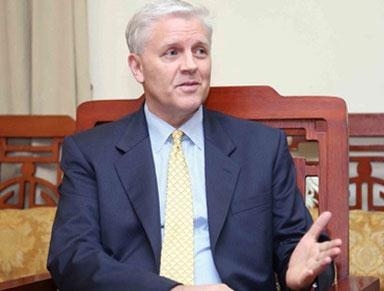

| ADB country director in Vietnam Eric Sidgwick __Photo: Internet |

Many countries’ experiences have shown that the introduction of a list of priority and feasible PPP projects of high standards which explicitly shows the government’s commitments is of great importance for attracting foreign investment capital to such projects.

Transparent PPP project bidding process and procedures and well prepared projects will help reduce transaction costs and private investors better understand the mechanisms for the State’s capital contribution and risk sharing, especially the government (public sector) guarantee for certain types of risks which are viewed by investors and banks as not complete and clear enough.

According to the ADB country director, the successful implementation of a number of simple PPP projects is extremely significant as it would create an important precondition for the implementation of more complicated projects through accumulating knowledge and experience.

The Ministry of Finance is coordinating with the Ministry of Planning and Investment in drafting several circulars guiding Government Decree No. 15/2015/ND-CP concerning state financial guarantee and aid, and criteria for selection of, PPP projects.- (VLLF)