With around USD 184 billion disbursed over the past 30 years since the enactment of the Law on Investment in 1987, the inflow of foreign direct investment (FDI) has significantly contributed to the country’s total social investment capital.

According to the Ministry of Planning and Investment (MPI), from 15 percent in 2005, the share of FDI in the total social investment capital increased to 23.7 percent in 2017. The FDI’s contribution to the country’s GDP rose from 6.3 percent in 1995 to 19.6 percent in 2017.

In addition, the FDI sector’s contribution to the state budget galloped from USD 1.8 billion during 1994-2000 to USD 14.2 billion during 2001-10, and to USD 23.7 billion during 2011-15. In 2017 alone, this sector contributed USD 8 billion to the state budget, accounting for 17 percent of total state budget revenue.

|

Limitations and recommendations

Although the above figures clearly attest to the country’s achievements over 30 years of FDI attraction and use, according to a MPI report, there remain several shortcomings which the country should overcome in order to make the better use of FDI in the coming period. First, the FDI sector’s linkage with other domestic sectors remains weak and its spillover effect on productivity remains low. Second, the attraction and transfer of technology from the FDI sector has not yet achieved the expected results. Third, the attraction of foreign investment into a number of prioritized sectors of the country and from transnational corporations is still limited. Fourth, a small number of FDI projects have not yet strictly observed the laws on environmental protection, employment of foreign workers and tax.

On the sidelines of a conference reviewing 30 years of FDI mobilization in Vietnam held on October 4 in Hanoi, foreign investors frankly pointed out shortcomings and made suggestions for the country to lure more foreign investment in the coming time.

Kyle F. Kelhofer, International Finance Corporation Country Director (IFC) for Vietnam, Laos and Cambodia suggested the country change from passive to active and targeted investment promotion and build a 4.0 investment environment suitable to business needs in the era of digital technology. Backward and cumbersome procedures should be replaced by online solutions convenient to users.

Sharing the same view, Ryu Hang Ha, Chairman of the Korean Chamber of Business (Kocham) said in the new context, the country should enhance the competitiveness of its business investment environment and invest in new, high-quality infrastructure and ensure human resources for science and technology.

“An investment environment with tax incentives is not enough. What we need is the Government’s comprehensive and friendly policies with tax being just a small part. Especially, administrative procedures should be processed in a clear, transparent and prompt manner. For investors, creditability is the top priority,” Ryu Hang Ha said.

Koji Ito, President of Japan Chamber of Commerce and Industry (JCCI) in Vietnam recommended a pilot scheme to speed up the administrative procedure reform, firstly applying to the General Department of Customs, to tackle such problems as lack of understanding of regulations, sharing of information and coordination among related sectors and unclear explanations and instructions, thus meeting current urgent needs of foreign businesses.

Chairman of the American Chamber of Commerce in Vietnam (AmCham) Michael Kelly noted that not a few American businesses have invested billions of dollars in supporting Vietnam to integrate into global value chains, creating high-quality jobs for local workers.

However, he said, many investments have not been realized because of challenges from the legal environment and unclear, complicated and problematic licensing procedures. AmCham members are expecting more reforms to create a more competitive and equal environment, prompt issuance of decisions and less cumbersome procedures.

In order to maintain and develop bilateral investment and commercial relations, particularly between domestic and FDI businesses, trade must be liberal and equal. Products imported into Vietnam’s market remain expensive and encounter complicated procedures. In the context of Vietnam’s increasing trade surplus to the US market, the Vietnamese Government should remove technical barriers to trade and non-tariff barriers facing businesses every day at border gates. Such barriers are restricting business operation and affecting the US’s export to Vietnam, he said.

Nicolas Audier, Co-Chairman European Chamber of Commerce in Vietnam (EuroCham) suggested Vietnam further cut administrative procedures, support and make further guidance on policies for private businesses, ensure an effective investment protection mechanism, improve dispute resolution mechanisms and consistently implement the Laws on Investment and Enterprises. He also expected to see positive changes in the enforcement and protection of intellectual property rights and the implementation of the Law on Technology Transfer.

Tax policies should be improved to attract foreign investment and international cooperation, for example, the calculation method of excise tax in the automobile sector should be changed. The revision of regulations on and application of higher excise tax rates for imported wine and liquor products will only increase the risks of illegal and uncontrollable consumption of liquor and beer products, threatening consumer health.

Along with continuing to affirm the role of foreign investment as an important component of the economy, which is encouraged for long-term development, Vietnam must focus on improving its institutions, laws and policies to increase the quality and effectiveness of foreign investment and its contribution to the country’s socio-economic development in the coming time.

FDI attraction orientations in the coming time

Based on the assessment of achievements as well as shortcomings and difficulties in attracting and using foreign investment over the last 30 years, taking into consideration the current domestic and international developments, the Vietnamese Government has initially identified orientations for attracting foreign investment.

In terms of investment sectors, Vietnam will prioritize attracting foreign investment into high, advanced and environment-friendly technologies, clean and renewable energy; medical equipment production and high-quality healthcare services, education and training, luxury tourism, financial, logistics and other modern services; high-tech and smart agricultural production; development of modern technical infrastructure, especially new sectors based on the fourth industrial revolution.

It is necessary to ensure harmony between export growth, investment for development of value-added products and services, use of local resources, development of supportive industries and training of domestic human resources.

In further attracting foreign investors and foreign-invested enterprises, Vietnam will give especial priority to transnational corporations aligned with domestic businesses to establish and develop sectoral clusters to join value chains.

The country will continue attracting foreign investment in sectors and fields in which it has strengths, such as textiles and footwear, but focus on the stages that create high added values and involve smart and automatic production processes.

In terms of geographical areas, foreign investment attraction will suit the advantages, conditions, development levels and plans of each locality and its regional linkages, ensuring economic-social-environmental effectiveness. For sensitive areas related to national defense and security, border areas, sea and islands and exclusive economic zones, the foreign investment attraction will be strictly scrutinized, with national defense and security and sovereignty being primary concerns.

Regarding markets and partners, Vietnam will step up the multilateralization and diversification of foreign investment attraction from potential markets and partners, attaching importance to existing markets and partners like Japan, the Republic of Korea, Singapore, the US, Germany and the UK. It will effectively utilize the relations with strategic partners, focusing on top developed nations and transnationals with source and advanced technologies and modern governance expertise.

The country will proactively monitor and assess the trend of foreign investment and the flow of backward and environment-unfriendly technologies into Vietnam from some regional countries to select investment projects in line with the set orientations.

Attraction of foreign investment from small- and medium-sized enterprises and small and micro projects must ensure the requirements on technological upgrade, participation in production networks and global value chains, and development of supportive industries. In addition, in order to attract foreign investment Vietnam will take advantage of its ASEAN Economic Community membership and opportunities brought about by free trade agreements.

|

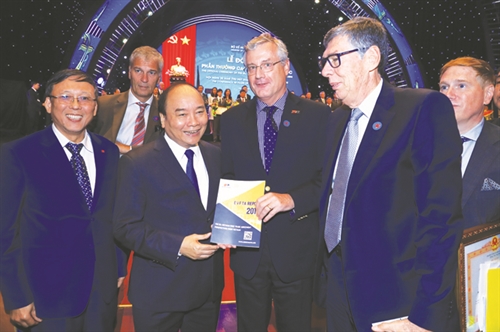

| Prime Minister Nguyen Xuan Phuc poses for a photo with delegates to the Conference on 30 years of FDI attraction in Vietnam__Photo: Thong Nhat/VNA |

Major solutions

To realize the above orientations, Vietnam is determined to further step up reforms, focusing on three major solutions.

Firstly, the country will complete economic institutions, improve the business and investment environment up to the standards of a modern and integrative market; fully respect the freedom of business, ownership and property rights of investors, including foreign ones; effectively operate different types of markets; push up the marketization of production factors and synchronously implement solutions to reduce operation and investment costs in order to raise the nation’s competiveness.

The legal framework on investment, enterprises, planning, management of foreign workers, tourism, and immigration and residence of foreigners will be improved in order to materialize the policy of attracting and using FDI in a selective manner and to increase the efficiency and effectiveness of the state management of foreign-invested enterprises and their foreign employees.

Particularly, current laws will be revised in tune with the 2018 Law on Competition to consistently regulate mergers and acquisitions, including those involving foreign investors, strictly control foreign investors’ or foreign-invested enterprises’ acquisition of domestic businesses, especially large and technology platform-based firms.

Comprehensive solutions, from completing the legal system and policies (relating to foreign exchange, tax, customs, science and technology, investment, etc.), building databases for enterprises to disclose information, will be introduced in order to prevent, limit and punish the transfer pricing and tax evasion of enterprises, including foreign-invested ones.

Concerning this issue, at a press conference held on October 13 to announce criteria for assessment of 2018 enterprise development support levels, Minister of Planning and Investment Nguyen Chi Dung said the Ministry’s Foreign Investment Agency will develop indicator-based FDI management tools to help not only investment promotion, approval and encouragement but also assessment of the efficiency of FDI attraction and use.

This set of indicators will include such ratios as investment/use land area for a number of projects occupying vast land areas; labor/investment fund to determine labor intensity levels; investment in research and development (R&D)/total investment; training and use of skilled workers and managers/total number of workers; and investment in environmental protection/total investment, etc. The grant of investment incentives to FDI enterprises will be even based on specific criteria such as use of raw materials supplied by domestic enterprises; number of domestic enterprises as business partners; R&D investment/total investment; and funds for employee training and retraining/total investment, etc.

Secondly, the capacity of domestic enterprises will be strengthened and their partnerships with foreign-invested enterprises will be promoted.

Thirdly, the state management apparatus will be strengthened in the direction of clearly distinguishing the functions and tasks among agencies and between central and local administrations and determining the coordination mechanisms among ministries and sectors. The collective leadership and individual responsibility will be made clear. The training of central and local officials will be stepped up, especially training in the knowledge about the functions and tasks of the public sector and policy making and implementation capacity.

The decentralization mechanism as well as monitoring, inspection and examination mechanisms will be further improved with a view to promptly solving difficulties and creating favorable conditions for business and investment activities of FDI enterprises while effectively supervising the observation of their commitments and business conditions, especially those operating in the sensitive areas.

Entering into a new development period, beside major challenges, Vietnam is bestowed with opportunities for its leapfrog economic development. In order to seize these opportunities, the country should address existing shortcomings and limitations and effectively implement new policies to attract more FDI of higher quality, meeting the requirements of international integration and fast and sustainable economic development.- (VLLF)