|

| Agribank digital automatic banking machines__Photo: Agribank |

The need for cashless payment and convenient digital financial services is becoming an essential part of life. Agribank has many policies and solutions to develop new payment services, functions and utilities using modern technologies to meet the increasing needs of customers.

After launched, many of Agribank's e-banking products and services have gained customers’ trusts such as opening electronic know-your customer (eKYC) online accounts, non-physical cards, contactless chip cards, electronic pin (ePIN), payment using VietQR codes and multi-function ATMs (CDMs), etc.

|

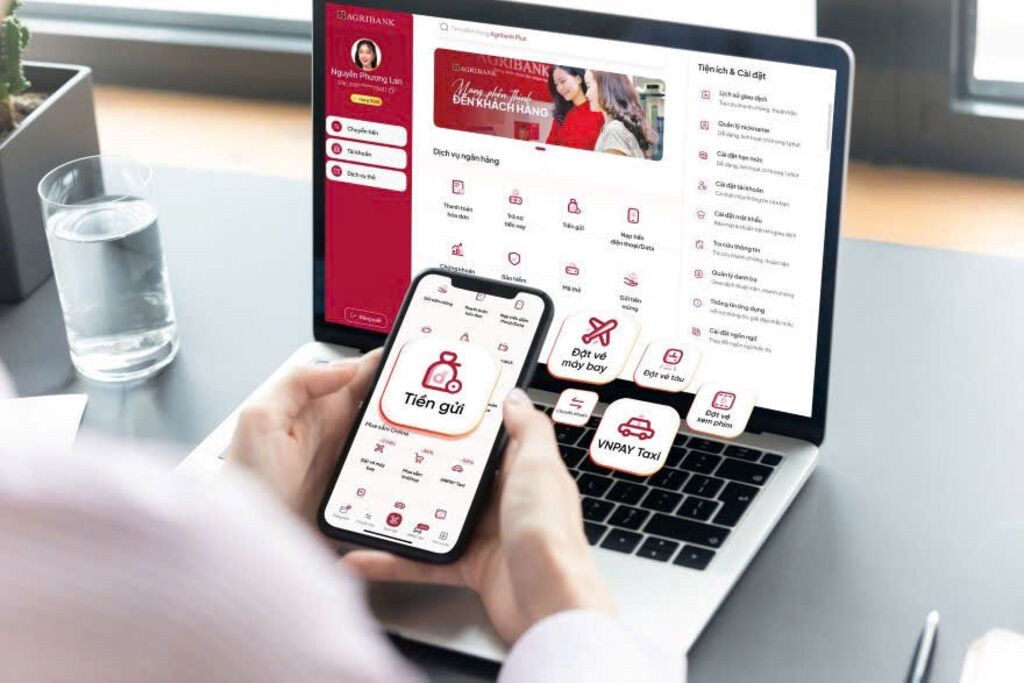

| Agribank offers cashless payment and convenient digital financial services.__Photo: Agribank |

Realizing that digital transformation is a key task, every year, Agribank allocates a large budget to invest in developing and applying information technology systems, ensuring operations for an average of millions of transactions per day, of which automated transactions account for 91.9 percent.

Agribank currently has nearly 20 million customers with payment accounts, nearly 16 million customers using ATM cards, nearly 15 million customers using payment services via Mobile Banking channel; more than 3,500 ATMs/CDMs (nearly 2,000 machines located in rural areas), nearly 25,000 POS machines, and 68 mobile transaction points using specialized cars operating in rural areas.

|

| Agribank's e-banking products and services win customers’ trusts.__Photo: Agribank |

Under its rural digitalization strategy, Agribank sets the goal of using technology to simplify procedures, helping people easily access the most basic banking services. To realize this goal, Agribank plans to deploy and install Agribank digital automatic banking machines in all rural, remote and isolated areas, especially those with limited access to conventional financial products and services, so that people can use digital banking utilities for public service activities as well as daily transactions.

|

| Agribank Digital automatic bank model__Photo: Agribank |

Agribank Digital automatic bank model is operating with the most modern and advanced technologies today such as electronic identification (eKYC); biometric recognition (Face ID, fingerprint recognition), etc. guaranteeing a high level of security regarding the identity and authenticity. Each Agribank Digital machine is fully equipped with banking transaction functions such as identification, registration of facial and fingerprint biometric information; registration to open accounts, issuance of cards online, etc. With the Agribank Digital experience, all transactions are automated with fast processing speed and high accuracy while empowering customers to self-serve their transaction needs.

Further promoting ongoing digital transformation endeavors, Agribank will continue to deploy and promote digital transformation activities to improve quality, operational efficiency and increase customer satisfaction.- (Anh Phuong)