|

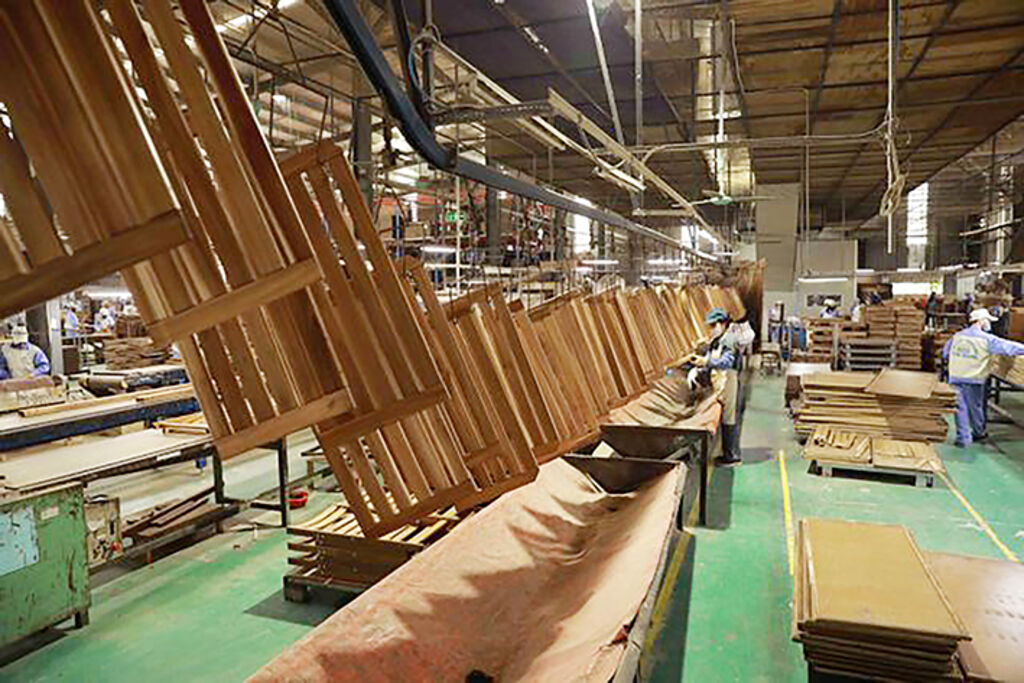

| Making wooden furniture at a factory in Tuyen Quang province__Photo: Vu Sinh/VNA |

Getting a value-added tax (VAT) refund is crucial for a business continuity plan, especially in the post-pandemic context, as it helps enterprises refresh their cash flow and provides them with additional resources for recovery and development.

Under the current Law on Tax Administration, tax authorities will classify businesses’ tax refund dossiers into two categories: “refund first, check later” and “check first, refund later”. The time limit for a tax office to process a request for tax refund and issue a letter of approval of tax refund will be counted from the date it receives a complete and valid dossier, which is six working days for taxpayers eligible for tax refund in advance or 40 days for those subject to inspection before tax refund.

However, the procedures for VAT refund are seemingly not straightforward and it is not easy for businesses to receive the refunds.

Complaints of businesses

Addressing at a seminar titled “Flexibly administering the monetary policy and growth targets in the new context” held in Hanoi on July 20, Dau Anh Tuan, Deputy Secretary General-cum-Head of the Legal Department of the Vietnam Chamber of Commerce and Industry, said many businesses are facing cash flow problems resulted from delay in VAT refund.

Nhat Linh Co. Ltd., the manufacturer of LiOA automatic voltage stabilizers, can be cited as a typical example. Nhat Linh President Nguyen Chi Linh revealed to the Tuoi Tre that the company has a total refundable VAT amount exceeding VND 200 billion but yet to receive any refund since the beginning of 2023, of which LiOA Dong Nai has a refundable amount of around VND 150 billion; LiOA Bac Ninh, VND 30 billion; and LiOA Hanoi, VND 23 billion.

“LiOA is now hanging by a thread. We’re in danger of bankruptcy and our 2,000 workers will probably become unemployed,” Linh lamented, citing cash flow disruptions as the main reason behind the situation.

For agro-forestry product exporters, the circumstance is even worse. According to Ngo Si Hoai, Vice President and Secretary General of the Vietnam Timber and Forest Products Association, the total VAT amount not yet refunded to wood processing companies is estimated to be around VND 6 trillion (USD 255 million) but the actual figure is likely to be much larger. “This causes great losses to wood businesses amidst current difficulties in processing and exporting wood products,” Hoai said to the Tuoi Tre.

According to a survey by the Private Economic Development Research Board, about 51 percent of the respondents said they were facing cash flow problems and 45 percent were hampered by red tape.

“Many firms have been driven into indebtedness because of delays in tax refund. Some of them have not received tax refunds for almost three years,” the Việt Nam News daily quoted the survey report.

Explanations from tax authorities

While businesses complain about delay in tax refund, tax authorities have their own explanations for the situation. Let’s examine the case of Nhat Linh Company, more specially, LiOA Dong Nai - the company’s branch in Dong Nai province.

A leader of the Dong Nai Tax Department told the Tuoi Tre that prior to 2023, LiOA Dong Nai was entitled to “refund first, check later”. In the 2019-22 period, the tax amount paid by the company was just VND 15 billion while the refund it received amounted to VND 521 billion.

Moreover, it is detected through an inspection of LiOA Dong Nai’s tax finalization for 2019-22 that the majority of the company’s input suppliers are in the state of “inactive at the tax registration address” or “having ceased operations but not completed procedures for invalidation of the tax identification number” or “having suspended business operations for a definite period”.

Being suspicious of potential tax evasion, the Dong Nai Tax Department decided to further review the company’s tax refund requests up to March 2023 and found that from January 2019 to March 2023, LiOA Dong Nai showed signs of using illegal input VAT invoices issued by 66 suppliers with a total value of VND 5,880 billion, corresponding to a VAT amount of VND 588 billion. In mid-August, the Dong Nai Tax Department forwarded the LiOA Dong Nai case file to the provincial public security agency for criminal investigation.

“We will proceed with tax refund as soon as we obtain investigation results or opinions of the investigation police agency or another authority, or receive sufficient documents as prescribed by law,” the leader of the Dong Nai Tax Department affirmed.

Regarding the timber industry, statistics from the General Department of Taxation showed that more than 7,600 wood processing businesses no longer exist at their registered addresses or have suspended operations. Besides, after tracing timber origin, tax authorities even detected numerous cases in which forest growers supposed to be the tier-zero sellers of timber turn out to be households that are neither allocated forest land nor involved in timber trading.

Solutions for avoiding tax loss and accelerating tax refund

According to the General Department of Taxation, the tax authority would continue proposing the Ministry of Finance, Government and National Assembly to consider revising a number of regulations on enterprise registration with a view to preventing illegal trading and use of invoices and profiteering from the VAT refund policy.

Truong Thanh Duc, director of ANVI Law Firm, told the Tuoi Tre that the current law does not limit the number of companies of which a person may act as the director as long as he does not fall into cases prohibited from establishing and managing a business in Vietnam.

“But the key point is the purpose of establishing an enterprise, whether it is to conduct production and business activities in accordance with law or to trade in invoices, evade tax and so on,” Duc said, adding that authorities should adopt a mechanism to strictly monitor and manage post-registration operations of enterprises.

Senior tax and corporate governance expert Nguyen Van Phung agreed with lawyer Truong Thanh Duc’s point of view. “The procedure for setting up an enterprise is extremely open, simple, easy, and low-cost. However, the mechanism for functional agencies to check production and business operations of enterprises is both ineffective and impractical. This is one of the causes that are attributable to the blossoming “ghost” companies for the purpose of profiteering from VAT refunds,” Phung analyzed.

“The ultimate goal of “ghost” businesses is to appropriate VAT refunds which are amounted to VND 100-150 trillion per year, equivalent to about 10 percent of the annual state budget revenue. However, there exist many loopholes in the VAT policy, especially the tax refund stage, which are seen as fertile land for illegal practices over the past years,” Nguyen Ngoc Tu, former Editor-in-Chief of the Tax Magazine, shared his viewpoint.

To deal with the situation, most experts recommended the revision of the Law on Value-Added Tax, which was enacted more than 20 years ago and hence, has become inappropriate.

Accordingly, the Law should have regulations binding a person with the enterprise he founds. This is the most fundamental issue that, if solved, will help prevent the formation of “ghost” companies for illegal invoice trading and tax evasion.

While revising laws to avoid tax loss, authorities should also review existing regulations and remove burdensome and unreasonable ones that lead to the current stagnation in VAT refund.

For example, timber companies are now required to produce to tax offices the proof of origin (P/O) of input materials to be eligible for tax refund. However, the requirement seems to be too hard to be accomplished because timber businesses often buy feedstock from multiple suppliers and then it is impossible to trace timbers back to every single one of them, given the multiple layers of sellers in the supply chain.

Speaking at a press conference held in early August, Deputy Minister of Finance Nguyen Duc Chi revealed that the ministry will, in the time to come, report amendments to current regulations on objects liable and not liable to VAT, tax rates and conditions for VAT refund for exported goods to competent authorities for consideration. Regulations on tax refund dossiers and procedures will also be reviewed so as to shorten the time for processing tax refund requests of enterprises.- (VLLF)