|

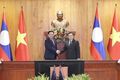

| An overview of the conference__Photo: VNA |

All stakeholders from the Government, ministries, sectors, to banks, people and businesses must join hands together with highest responsibility in promoting national economic growth, ordered Prime Minister Pham Minh Chinh at a conference in Hanoi on December 7 to discuss way to tackle difficulties in credit growth for production and business, and promote economic growth and macro-economic stability.

Credit access conditions will not be lowered but should be applied flexibly to suit the reality, while fiscal policies related to capital, fees, charges, public investment and other areas should be strengthened to support monetary policies, the PM said.

According to the State Bank of Vietnam (SBV), as of November 30, credit provided to the economy had reached VND 13 quadrillion (USD 535.49 billion), up 9.15 percent over the end of 2022. Of the total, outstanding loans in the agro-forestry-fisheries sector was about VND 918.6 trillion, while that in the industry-construction sector reached more than VND 3.32 quadrillion, an increase of 7.31 percent, and the service industry nearly 8.6 quadrillion VND, a rise of 7.9 percent.

PM Chinh said that as the credit growth target for the whole 2023 is 14 percent, there is plenty of room for credit institutions to expand their credit with about VND 700 trillion to be provided to the economy.

He held that in order to effectively and drastically implement measures to strengthen credit access and increase bank’s capital serving economic growth, the SBV should continue to make active and flexible regulation of monetary policies, prioritizing the promotion of economic growth and credit growth in parallel with ensuring the safety of the banking and credit institution system, and harmonizing the interest rates and exchange rates to match the market situation, macroeconomic developments, and goals of monetary policies.

Along with rolling out suitable credit solutions, it is necessary to enhance credit quality and drive credit to production and business activities as well as prioritized areas and motivations of the economy, while controlling credit in areas with potential risks, asked the PM.

He suggested that the SBV consider making public the average interest rates of the credit institution system and the average lending interest rates of each credit institution as well as the gap between deposits and loans, thus creating favorable conditions for businesses and people to make decision on borrowing money from banks.

At the same time, the central bank should continue to direct the drastic and effective implementation of the VND-120-trillion package for social housing and the VND-15-trillion package for the forestry-fisheries sector, requested the Government leader.

Alongside, it is necessary to review, adjust, supplement, and extend the implementation of issued circulars to suit the reality, he said, stressing the need to continue building new legal documents to amend regulations regarding credit activities.

The SBV was ordered to coordinate with relevant ministries and sectors to continue realizing measures to develop the business bond and securities markets, and remove difficulties for the real estate market.

PM Chinh also asked credit institutions to continue cutting cost and simplifying lending procedures and conditions, thus reducing lending interest rate and increasing the credit access for people and businesses.

At the conference, the Government leader also assigned specific tasks to particular ministries, agencies, sectors, and localities..- (VNA/VLLF)