Bitcoin and other similar virtual currencies like ethereum, ripple and litecoin have become a hot topic among investors. But let’s set aside the worries and excitement and ask a question: are cryptocurrencies lawful in Vietnam?

|

| Photo: Internet |

The State Bank of Vietnam (SBV) has recently issued a statement affirming that cryptocurrencies are not a lawful means of payment in Vietnam.

The central bank invokes Article 4.6 of Decree 101 of 2012 on non-cash payment which says that Vietnam recognizes only checks, payment orders, collection orders, bank cards, and some other SBV-prescribed payment instruments as lawful means of payment. All other non-cash payment methods are considered illegal.

It also underlines that under Vietnamese law those who issue, supply or use illegal means of payment, including bitcoin and other digital currencies, will face a fine of between VND 150 million and VND 200 million, roughly USD 6,000-9,000.

Moreover, as of January 1, 2018, acts of issuing, supplying and using illegal means of payment can be criminally prosecuted, the statement reads.

However, there remains uncertainty about the legal definition of cryptocurrency. Should it be regarded as “money” or “commodity”?

Right after the SBV issues the statement forbidding the use of cryptocurrencies as a payment instrument, Vietnam Bitcoin Company Limited, the owner of bitcoinvietnam.com.vn - a popular virtual currency exchange in the country, publishes on its website an announcement saying that it does not violate the law, the Tien Phong daily reported.

“Vietnam Bitcoin Company Limited always lists trading prices of bitcoin in Vietnam dong. Moreover, the current law has not yet specified whether bitcoin is a currency or commodity or payment instrument, this means that bitcoin trading services are not payment services and, therefore, bitcoin exchanges and traders are not governed by Decree 101 of 2012,” the company justifies, adding that bitcoin is not banned from trading and use as a type of intangible goods.

Vietnam Bitcoin Company is not the only one that mentions the possibility of considering bitcoin a commodity.

In an interview with Doi Song va Phap Luat newspaper, lawyer Le Cao from Da Nang City Bar Association said: “If considering bitcoin a means of payment, it is not yet accepted by Vietnamese law. However, things would be different if bitcoin is regarded as a commodity and bitcoin transactions are just civil-economic deals between organizations and individuals that voluntarily enter into barter agreements.”

Citing the case of FPT University - a leading information technology school that had earlier announced a plan allowing foreign students to pay tuition fee in bitcoin, Cao argued: “Maybe, FPT University does not think of it as the receipt of a payment instrument but acceptance of a barter agreement. Suppose FPT University has a program of exchanging and accepting bitcoin instead of collecting tuition fees, which is not the use of a means of payment, competent authorities can hardly punish it.”

“It is believed that when bitcoin is accepted as a lawful currency and means of payment, the national sovereignty over the issuance of currency will be infringed upon, affecting the effectiveness of the monetary policy,” Cao commented on the SBV’s view to reject bitcoin as a legal payment instrument.

“Moreover, if bitcoin is accepted, it will be difficult to control, tax evasion, illegal transfers and payments, and financing of illegal transactions will arise, thus making the state management of monetary and economic issues very complicated. However, whether bitcoin is banned or accepted, bitcoin-related activities still exist and that is the problem we need to care about,” he added.

Many legal and economic experts share Cao’s opinions.

Addressing a talk show titled “Investment-Business Opportunities 2018” broadcast early this month by VTV24 News Center, former Deputy Minister of Planning and Investment Dang Huy Dong said he agreed that bitcoin should not be accepted as a lawful means of payment but “since it is very difficult to ban bitcoin, we should regard it as a type of property or commodity so as to facilitate tax collection and management work.”

Although there have been no official statistics about the bitcoin market in Vietnam, the total daily bitcoin trading value of the country is estimated at USD 100 million, Nguyen Viet Bach from bitcoin.vn told the Saigon Economic Times online.

“Surging profits from investment in bitcoin have attracted speculators, but incur possible risks,” said Chairman of Saigon Securities Incorporation Nguyen Duy Hung at a talk show on bitcoin and blockchain wave held in Hanoi last December, adding that the number of people wishing to join the game keeps increasing continuously.

Meanwhile, lawyer Truong Thanh Duc, Chairman of BASICO Law Firm, warned people to be aware that “bitcoin investment is extremely adventurous” as Vietnamese law does not officially allow bitcoin exchange platforms at brokerage firms and financial institutions. But he suggested the State not prohibit cryptocurrency investment and trading even though these activities are especially risky because “the higher the risk, the greater the opportunity.”

The question here is how to manage cryptocurrency-related activities so as to prevent the abuse of these activities for illegal purposes such as swindle, property appropriation and money laundering.

In late 2017, local media reported that three members of a family in Ho Chi Minh City committed suicide after losing everything they had on virtual currency exchanges.

Earlier in November 2017, the Public Security Department of the northern province of Bac Giang arrested three members of a criminal gang who had pocketed tens of billions of dong after raising money from residents in Bac Giang and neighboring localities for a bitcoin investment fund. Do Thi N., one of the clients, poured VND 400 million (USD 17,600) into the fund with the hope of receiving a per diem interest of 0.5 percent and the option to withdraw the principal after six months. Her money, unfortunately, was never returned.

For the time being, not only experts but also government officials have become aware of the need for a legal foundation to govern cryptocurrencies and deal with their negative aspects.

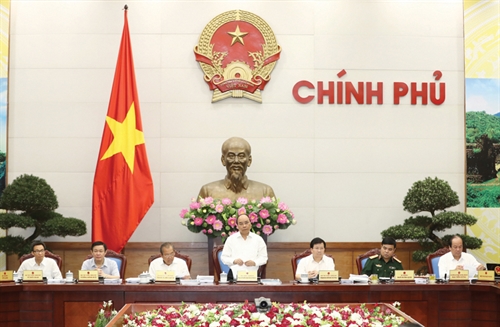

Speaking at a meeting to review the implementation of Prime Minister Decision 1255/QD-TTg approving the Scheme on completing the legal framework for managing virtual property, electronic currencies and virtual currencies, Minister of Justice Le Thanh Long said that Vietnam could not ignore virtual currencies anymore but needed to work out a legal corridor to govern them. “However, it is important to define what virtual currencies are so as to devise appropriate management methods,” he stressed.

According to Nguyen Thanh Tu, Director of the Ministry of Justice’s Department of Civil-Economic Laws, there are two options of making virtual currency regulations. The first is to issue a governmental decree on virtual currencies under Article 19.3 of the Law on Promulgation of Legal Documents. As per the second option, virtual currency trading will be added to the Investment Law’s Appendix 4 on conditional business lines.- (VLLF)