United Nations Development Programme in Vietnam

|

| Citizens carry out administrative procedures at the Public Administration Service Center of Dong Tien commune, Thanh Hoa province__Photo: Khieu Tu/VNA |

Introduction and context

On July 1, Vietnam embarked on a major transformation of its local government system, shifting from a three-tier to a two-tier administrative model (provinces and centrally run cities and communes/wards/special zones under provinces and centrally run cities). With the abolishment of the district administrative level, the commune administrative level assumes an increasingly pivotal role in the delivery of public services, the promotion of grassroots democracy, the enhancement of citizen participation, and the safeguarding of timely and convenient access to information, particularly in relation to budget transparency.

Law 89/2025/QH15 on the State Budget (the 2025 Law), taking effect on January 1, 2026, stipulates that state budget at all levels must disclose data and explanatory reports on budget documents, including budget estimates, budget allocations, and budget implementation status. In addition, state agencies and units with portals/websites are required to publicly disclose budget information on their respective portals/websites. Nonetheless, findings from the Vietnam Provincial Governance and Public Administration Performance Index (PAPI) over the years show that there is a large gap between what commune governments are expected to provide and what citizens receive in terms of access to information about state budget plans and expenditures at the commune level. The 2024 PAPI survey findings[1] showed that, on the national average, only 43.02 percent of the citizens said that their communes’ budget and expenditure lists were publicized, and this rate never went above 50 percent during the period from 2020 to 2024.

To look closer into the reason why budget disclosure status remains low, especially in the context of administrative unit restructuring, and to identify discrepancies between policy frameworks and practical implementation, the United Nations Development Programme (UNDP) in Vietnam, and the Vietnam Center for Economic and Strategic Studies (VESS) conducted a thematic study entitled: “Local budget disclosure in the context of administrative boundary rearrangement in 2025: A case study of budget disclosure in Lang Son province, Dien Bien province and Ho Chi Minh City.”[2] This action research constructively examined challenges and opportunities in local budget disclosure, to point out good practices and actionable suggestions for improvements at the local levels. Due to logistical limitations, apart from Lang Son, Dien Bien and Ho Chi Minh City, this research focused mostly on reviewing online disclosure channels.

This article draws evidence from the above action research to offer targeted recommendations for strengthening budget transparency practices nationwide. This work is timely, not only to promote compliance with the 2025 Law entering into force soon, but more importantly to enhance institutional accountability, efficiency, transparency and participation in the use and monitoring of public funds, in line with the 2022 Law on Implementation of Grassroots Democracy.

Status of local budget disclosure in 2025

Pre-merger review results

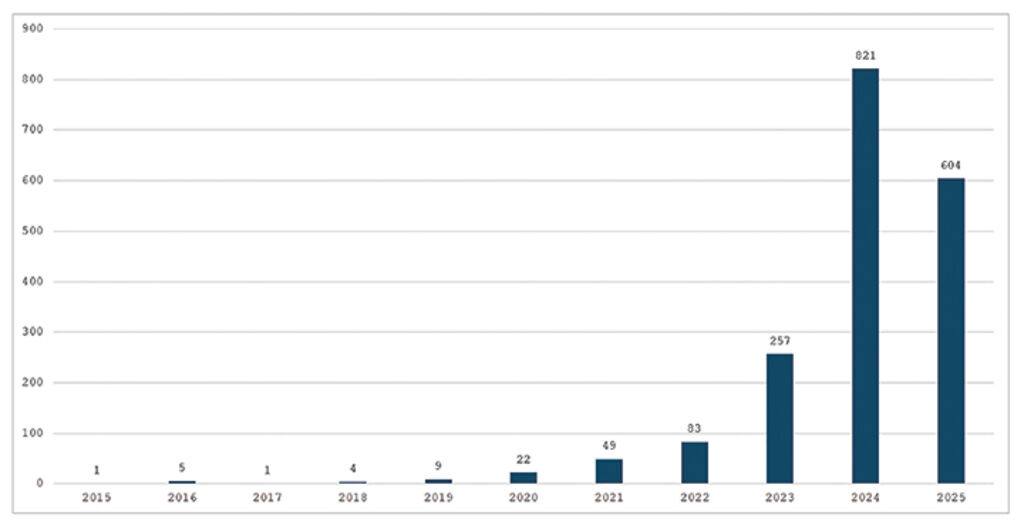

Before the July 2025 merger, there were 10,035 commune-level administrative units nationwide, among which 7,805 communes (77.78 percent) had a dedicated commune-level government portal or website (commune portals). Out of these 7,805 communes, 1,856 communes (23.8 percent) had at least one budget public disclosure document from any year on their portals. For budget documents related to the 2025 fiscal year, as Figure 1 reveals, only 604 communes (7.7 percent) publicly disclosed at least one type of document, a sharp reduction from 821 communes in 2024.

Figure 1: Statistics on the number of communes that publicly disclosed at least one most recent budget document by fiscal year at the time of review (May 2025)

|

| Source: Data compiled by the research team |

Post-merger review results

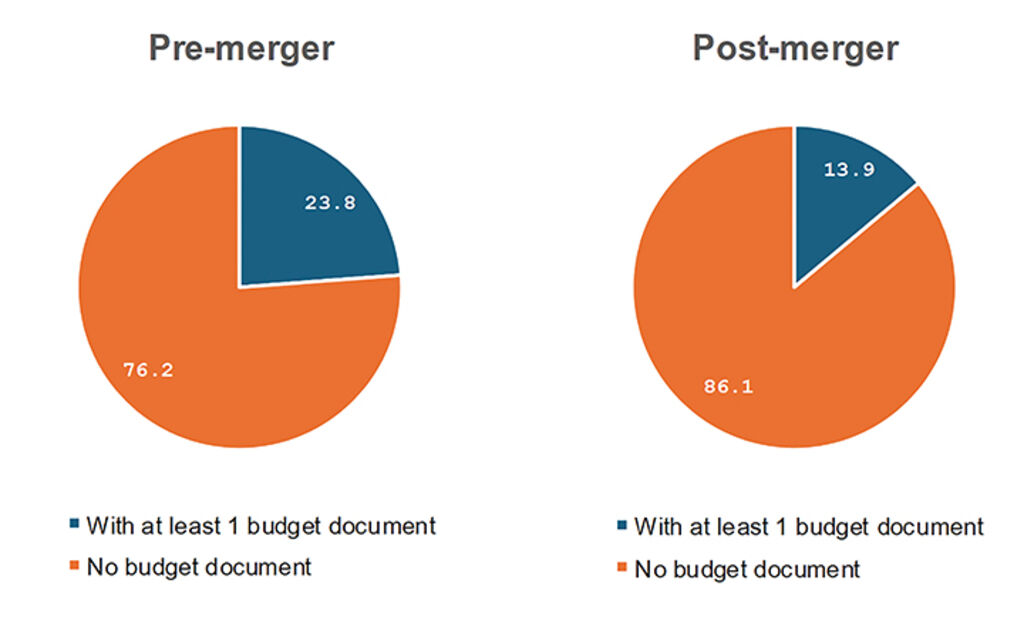

After the July 2025 administrative unit restructuring, the number of commune-level administrative units reduced from 10,035 to 3,321 nationwide. Among these 3,321 commune-level units, 85 percent had commune portals running, as examined during July of 2025. However, only 13.9 percent of these portals had posted at least one budget document. Notably, Ho Chi Minh City, which had the largest number of commune-level administrative units (168 in total), had not yet established commune portals at the time of review.

Figure 2 indicates that, although the share of communes with portals increased after the merger as compared with the pre-merger period, the share of communes disclosing budget information online went down. Considerable work is therefore needed to promote budget disclosure, particularly given that the 2025 Law mandates online disclosure for units that have official portals/websites.

Figure 2: Percentage of communes with commune portals with at least one budget document posted before and after the merger

|

| Source: Data compiled by the research team |

The budget disclosure status became even more fragmented when examining what communes had actually posted on their websites/portals. For example, pursuant to Article 15.1.c of the 2015 Law on the State Budget (the 2015 Law), reports on the implementation of the 2025 first-half budget estimates must be disclosed no later than July 15, 2025. However, at the time of review, prior to the rearrangement, none of the surveyed wards, communes, urban districts, rural districts or provincial cities had disclosed the report on the implementation of the budget estimate of the first half of 2025. The situation remained unchanged after the merger, as no commune or ward had posted any budget disclosure documents at the time of review. A similarly low level of disclosure was observed for other legally required budget documents, including the 2025 budget estimates and allocations, and the 2026 budget estimates, among others. This highlights the need to explore the underlying challenges for budget disclosure and provide support to local authorities to strengthen compliance and enhance meaningful public financial transparency.

Challenges in budget disclosure after the merger

Lack of guidance on management of budget data before the merger

There was an absence of clear planning and strategy for managing and transferring information, including previously disclosed budget data from administrative units that ceased operation. After the merger, some former district-level portals were reassigned to new commune-level authorities, but the responsibility for updating, storing and publishing legacy content remains unclear, leaving budget information fragmented and largely inaccessible. For example, in Ho Chi Minh City, provincial-level portals of Ba Ria-Vung Tau and Binh Duong provinces remained active and provided historical budget data up to June 30, 2025. However, portals of former district- and commune-level units were no longer accessible, and no plan had been developed to manage or migrate from previous disclosures at the time of the review.

Limited access to pre-merger budget information and budget documents disclosed at commune People’s Committee offices

Given the absence of strategy for managing or transferring budget documents previously disclosed online, people interested in accessing budget information now must rely largely on hard-copy records if they want to access budget information. Although archival handover was completed in accordance with Circular 06/2025/TT-BNV of the Ministry of Home Affairs guiding the implementation of the 2024 Law on Archives, officials in Lang Son, Dien Bien and Ho Chi Minh City reported several practical challenges.

In Tam Thang ward (Ho Chi Minh City), previously under Ba Ria-Vung Tau province, all former accounting officers retired before the merger, making their replacements unable to easily interpret archived documents. In Lang Son and Dien Bien provinces, archived files were not categorized by completion status and all were sealed, making retrieval difficult for anyone who wishes to re-examine the documents. A civil servant in Dien Bien province said during an interview: “Everything is stored in the archive. Whenever I need some documents, I have to call [the archival bureau] to acquire them. If not approved, I have to plead and persist. It takes weeks to obtain them.”

This indicates that even though citizens can still request access to hard-copy budget documents that belong to the pre-merger period in accordance with Article 21 of Circular 06/2025/TT-BNV, the complexity of procedures and limited administrative readiness may hinder timely access, underscoring the need for improved transition planning and support to local authorities.

Meanwhile, public posting at commune/ward People’s Committee offices remains the most common disclosure method as required by the 2025 Law. However, after the merger, administrative boundaries have expanded significantly, increasing the distance between citizens’ homes and commune/ward People’s Committee offices, especially in mountainous areas. For example, in Dien Bien, the farthest villages are about 25 kilometers from Na Tau commune and 15 kilometers from Muong Ang commune. In Lang Son, the farthest villages in Chi Lang and Van Linh communes are 12 kilometers away. Local officials noted that these long distances reduce citizens’ ability to access public services, including budget information posted at commune agencies’ offices. This underscores the need to shift to online disclosure, apart from the relocation of physical information disclosure points to places nearer and more accessible for citizens.

Differences across localities in arrangement of finance-planning staff affecting budget disclosure

There are significant disparities among the surveyed communes with respect to human resources responsible for finance and planning functions, which are performed by the Economic Division (for communes) or by the Division of Infrastructure and Urban Development (for wards). For example, Chanh Hiep and Binh Duong wards in Ho Chi Minh City had the largest number of specialists and staff in charge of finance and accounting, with five and six persons, respectively. In contrast, Dong Kinh ward and Van Linh commune in Lang Son province each had only one officer responsible for finance and budget affairs. The main reason for this situation is that accountants of pre-merger units retired under Government Decree 178/2024/ND-CP, while local authorities were unable to reassign personnel from other localities in accordance with the guidance of the Government’s Steering Committee on Rearrangement of All-Level Administrative Units and Establishment of the Two-Tier Local Government Model, as stipulated in Official Letter 09/CV-BCD dated May 30, 2025, concerning temporary orientations for personnel allocation.

In addition, there are significant gaps in the knowledge, skills and experience of commune-level financial officers and civil servants. In some localities, such as Tan Dinh and Binh Duong wards in Ho Chi Minh City, financial officers were appointed in line with their professional qualifications and competencies, thereby contributing to the effective implementation of budget disclosure for wards. However, there are also cases in which commune-level budget officers were appointed without relevant expertise or experience, due to such reasons as the retirement of experienced staff. This situation has created considerable difficulties in implementing financial and budgetary functions at the commune level, including budget disclosure, particularly in the context where communes are now delegated and authorized with greater responsibilities in fiscal management under the two-tier local government model.

Commune-level disclosure indicators, content and templates not updated to reflect functions transferred from the dissolved district governments

Following the merger, commune and ward authorities now have broader financial mandates than before. Under Government Decree 125/2025/ND-CP dated June 11, 2025, on delegation of authority of two-tier local administrations in the fields under the Ministry of Finance (MOF)’s state management, commune-level administrative units are assigned several responsibilities of former district-level administrative units, including implementing national target programs and managing public assets. The commune-level financial model has also changed. As per MOF’s Official Dispatch 11113/BTC-NSNN dated July 21, 2025, guiding the implementation of several finance-state budget affairs at the commune level, multiple agencies and units at the commune level are now designated as tier-I budget-estimating units, reflecting a structure similar to the former district model, rather than the previous single-unit commune model.

However, at the time of review, commune and ward finance officers had not received guidance on which disclosure indicators or templates should apply in the new context. Applying old commune-level templates would leave out newly transferred district-level budget responsibilities, while using old district-level templates lacks a legal basis. Several officers reported uncertainty over both disclosure formats and signing authority, which may delay compliance and subsequent budget processes.

Due to the lack of guidance, Tan Dinh and Binh Duong wards in Ho Chi Minh City disclosed their 2025 budget estimates using existing commune-level forms under MOF’s Circular 343/2016/TT-BTC guiding the implementation of budget transparency at all budget levels. While this complies with current regulations, it does not include newly transferred tasks such as expenditure estimates for agencies and units now under commune-level responsibility, resulting in partial disclosure.

Development of commune portals still underway

A quick review of commune portals in the three provinces under this study (Dien Bien, Lang Son and Ho Chi Minh City) showed an inconsistent approach to developing commune portals and online budget disclosure plans. As of August 1, 2025, none of the 45 communes in Dien Bien province had operational portals, let alone updating the budget disclosure sections thereon. Although the provincial portal lists all communes with hyperlinks, these links redirected to 24 old sites. As a result, none of the new communes had functioning portals and budget disclosure sections thereon. Some old portals still contained a “Budget revenue and expenditure estimates and final accounts” section, but they displayed former district-level budget information. This indicates a need to develop commune-specific disclosure sections once new portals are created.

In Lang Son province, all 65 communes and wards have functioning portals using a standardized provincial platform, and 64 have created a separate budget disclosure section. However, only nine communes have posted budget-related content, and these documents reflected former district-level information rather than that of the new communes.

In Ho Chi Minh City, as of July 31, 2025, only two wards (Phu An and Tan Uyen) out of 168 communes and wards had established their portals. Tan Uyen ward reused its former district portal and created a budget disclosure section but with budget information from the previous district-level government. Phu An ward developed a new portal, which has not yet contained a budget disclosure section.

Recommendations: strengthening budget disclosure and enhancing citizens’ access to budgetary information

The reorganization of administrative units under the two-tier model, as mandated by resolutions of the National Assembly, has created substantial challenges for budget disclosure and for ensuring citizen participation in the budget cycle. Therefore, the following recommendations are proposed to strengthen budget disclosure and enhance citizens’ access to budgetary information.

For the National Assembly and the Government

The National Assembly should examine and pilot institutional mechanisms that enable citizens and organizations to directly participate in budget deliberations during sessions of the National Assembly and People’s Councils at provincial and commune levels.

For its part, the Government should promptly issue a decree providing detailed guidance on state budget disclosure for the effective implementation of the 2025 Law. Such guidance should reintroduce specific provisions on the timing of disclosure for each type of budget document, as was stipulated under the 2015 Law. Should detailed timing not be specified, the decree should explicitly state that disclosure timelines must follow Article 18.4 of the 2016 Law on Access to Information.

At the same time, sanctions should be introduced for non-compliance with budget disclosure obligations, in line with existing penalties for violations of accounting, reporting, and budget finalization requirements.

The Government should mandate the Ministry of Home Affairs, in coordination with other relevant ministries, to develop guidance on the management and continued accessibility of information and data previously disclosed on the portals of pre-merger entities, including budgetary information. This would ensure uninterrupted public access to historical budget data and information.

It should also conduct assessments of the enforcement of budget disclosure regulations and report the findings to the National Assembly, the National Assembly Standing Committee and the President in accordance with law.

For the Vietnam Fatherland Front

The Vietnam Fatherland Front should strengthen the fulfillment of its mandate and responsibility to lead social supervision and criticism with regard to state budget information. It should provide guidance to, and promote the active involvement of, its member organizations in overseeing the exercise of citizens’ rights and obligations concerning the disclosure and transparency of budgetary information by agencies and budget-using entities.

It is necessary to integrate the content and results of the monitoring of budget disclosure implementation, along with an assessment of the current state of budget disclosure, into consolidated reports submitted to the National Assembly or the People’s Councils at provincial and commune levels via the Vietnam Fatherland Front.

For the Ministry of Finance, the State Treasury and the Ministry of Home Affairs

The Ministry of Finance should promptly issue a circular guiding budget disclosure under the 2025 Law (to replace Circulars 343/2016/TT-BTC, 61/2017/TT-BTC, and 90/2018/TT-BTC). The circular should establish disclosure indicators and templates aligned with the two-tier local government model, while ensuring compatibility with the Treasury and Budget Management Information System (TABMIS).

Guidance should also be issued for commune-level People’s Committees to post budget information both at commune offices and at village community houses. Budget disclosure tables should be displayed at locations frequently accessed by citizens, such as commune-level public service centers and community houses in villages. The circular should specify both the timeline and duration of such postings.

The ministry should further include in its guidance a provision encouraging entities to prepare and disclose “citizen budget reports” and to make use of social media platforms such as Zalo and Facebook for disseminating budgetary information.

Particularly, the State Treasury should support the Ministry of Finance in designing disclosure templates that are compatible with TABMIS and allow for efficient extraction of budget data. It should also ensure that budget-using entities have timely and convenient access to TABMIS, thereby enabling compliance with disclosure requirements.

Meanwhile, the Ministry of Home Affairs should work with relevant ministries in formulating guiding documents on the management of and access to stored information and data, including budgetary information, previously disclosed on the portals of pre-merger entities, to allow effective use of archived resources. It should also monitor local governments’ budget disclosure by integrating this indicator in the Public Administration Reform (PAR) Index.

For provincial- and commune-level People’s Councils

People’s Councils should strengthen the fulfillment of their obligations and responsibilities as elected bodies. Beyond publishing oversight plans, the results of oversight activities should also be disclosed in a complete and detailed manner. People’s Councils should intensify their monitoring of the compliance of agencies and units within their mandate with budget disclosure requirements.

Deliberations on the implementation and effectiveness of budget disclosure should be systematically incorporated into the regular sessions of People’s Councils.

For provincial-level People’s Committees and Departments of Finance

Provincial-level People’s Committees should direct relevant agencies such as the Departments of Home Affairs, Departments of Finance and commune-level People’s Committees to conduct a comprehensive review of the human resources currently responsible for finance-planning functions at the commune level. This should ensure that staff are appropriately assigned to positions that match their qualifications and competencies, and that both the quantity and quality of personnel meet local needs, in line with the guidance of the Government’s Steering Committee on Rearrangement of All-Level Administrative Units and Establishment of the Two-Tier Local Government Model, as set out in Official Letter 09/CV-BCD.

Provincial-level Departments of Finance should advise provincial-level People’s Committees to design and implement training and capacity-building programs for commune-level finance officers, with priority given to budget accountants, in line with Conclusion 179/KL/TW dated July 25, 2025, of the Politburo and Secretariat, on strengthening the organization and functioning of the two-tier local government model.

Adequate resources should be allocated for the development and improvement of portals of provincial- and commune-level governments. Depending on local conditions, budget disclosure sections may be placed on the provincial governments’ portals or on commune-level portals.

Conclusion

Administrative reform has fundamentally reshaped local budget governance. Commune/ward authorities now hold greater responsibilities for budget management and disclosure, creating opportunities for citizens to engage more closely with local budgeting. However, these reforms also reveal institutional, infrastructural and capacity gaps. Gaps in information management, shortage of human resources and digital infrastructure, together with the absence of legal mechanisms for direct citizen engagement, continue to pose significant challenges in constraining transparency and participation. Nevertheless, by leveraging institutional reforms, digital transformation, and capacity building for local officials, Vietnam has the potential to transform the merger process into a driver for building a more transparent, accountable and inclusive governance system - one in which citizens can participate substantively in the state budgeting process.-

[1] See more details at: https://papi.org.vn/chi-so/

[2] See more at: https://papi.org.vn/cong-khai-ngan-sach-dia-phuong-trong-boi-canh-sap-xep-lai-don-vi-hanh-chinh-nam-2025/