The bond market is an important capital mobilization channel for enterprises, contributing to the development of the whole economy. But recent violations related to bond issuances have cast doubts among investors, creating uncertainty in the market.

|

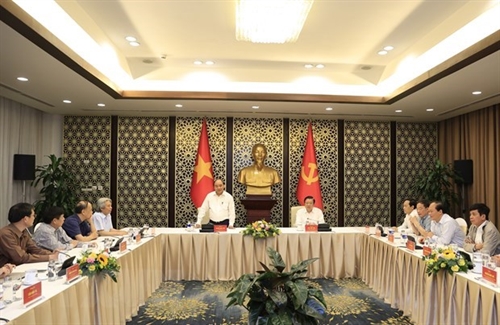

| The seminar on “Sustainably developing the corporate bond market” held by the Laborer Newspaper on April 19__Photo: Internet |

“In order to develop the bond market sustainably, we have proposed to the Government to settle and handle the cases soon to strengthen the confidence of investors and issuers, including businesses,” Can Van Luc, member of the National Advisory Council for Financial and Monetary Policies, said at a seminar on “Sustainably developing the corporate bond market” launched by the Laborer Newspaper on April 19.

These violations needed to be solved as quickly as possible and the results should be made transparent, he said.

Speaking at the event, Phung Xuan Minh, General Director of Saigon Ratings, stressed that the bond market was new compared to global markets.

“With 12 years of experience in surveying a number of international markets such as Japan, Korea and Malaysia, we realize that what we have been through are also their mistakes 20-30 years ago, where they were still primary markets,” Minh said.

“The market itself is not guilty, we are the one who made the policy.”

At the moment, the corporate bond market required three important factors, including state-oriented management, the transparency of information of credit rating agencies and the compliance of market participants such as issuers and rating agencies.

In particular, the Government needed to have a mechanism to create favorable conditions for market participants to develop and improve the credit rating culture, Minh added.

Therefore, consultation on improving the quality and effectiveness of building a legislative framework would be key at the moment.

In addition, the investors’ quality also had to be improved. Many experts had reached a consensus that investors, especially retail investors, lack financial knowledge and tend to follow the flow, which was very risky.

“In my opinion, to develop a sustainable corporate bond market, it is necessary to create powerful bond investors, which advanced countries have done,” said Tran Huy Doan, Deputy Head of Investment Department of ACB Securities Ltd., Co.

It was necessary to clearly specify the debt to capital ratio, experts said. Enterprises with larger loans than equity would inevitably fail like many have in the international markets.

Experts also proposed to develop a credit rating service market to help bondholders assess risks while making investment decisions. Currently, Vietnam has only two enterprises in the field, which is too few compared to market demand.

“The private offerings by enterprises require the participation of credit rating agencies,” Nguyen Thanh Ha, Chairman of the Board of Directors of SBLAW Law Firm, said at the event.

“When amending Decree 153 on bond issuance, it is mandatory to have the conclusion of the credit rating and evaluation organizations.

“The Vietnamese market currently has very few enterprises providing credit rating and assessment services, so in the near future, the Decree should open the door for experienced foreign organizations to participate.”

Moreover, post-inspection must be strengthened on the use of capital after a phenomenon that funds mobilized from bond issuances were not spent on the right purposes.

Concluding the seminar, To Dinh Tuan, Editor-in-Chief of the Labor Newspaper, said that it required the participation of all units, state management agencies and companies to build a sustainable bond market.

Enterprises also need to reflect on their activities in the past to adjust and improve themselves, while press agencies and media accompanies need to work with authorities and businesses to raise alarms and contribute to detecting violations.- (VLLF)