Metro Cash & Carry Vietnam’s transfer pricing fraud was uncovered as the retail giant was forced to cut losses and pay tax arrears totaling VND 507 billion (roughly USD 23.47 million) following a two-month inspection by the General Department of Taxation.

The fraudulent amount included VND 62 billion (around USD 2.87 million) in unpaid corporate tax, VND 110 billion (around USD 5.1 million) in improper value-added tax deductions and VND 335 billion (USD 15.5 million) worth of unreasonable loss.

Metro’s violations had been all clarified, particularly transfer pricing transactions, General Director of Taxation Bui Van Nam told online newswire VietnamNet, saying all fraudulent amounts would be immediately remitted to the state budget. He added inspection conclusions were reported to and approved by the Minister of Finance.

Inspectors found Metro Vietnam had conducted transfer pricing through transactions with its parent company Metro AG in Germany. From 2001 to 2013, Metro Vietnam paid its parent company a total VND 731 billion (roughly USD 33.84 million) just for the use of the “Metro” brand under a franchise contract between them, which consequently caused the former an unreasonable loss of VND 245 billion (USD 11.34 million). The firm also paid a hefty VND 699 billion in salaries, allowances and bonus to its board of directors and foreign experts through the parent company.

The inspection showed Metro had declared high depreciation of assets and made unreasonable risk provisions, resulting in a loss of VND 90 billion. The firm had also failed to declare some VND 110 billion received from suppliers for advertising, marketing and sales promotion support for value-added tax payment.

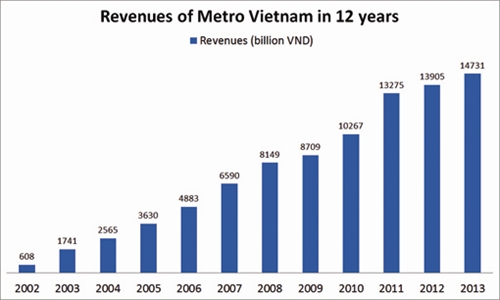

Metro Vietnam was licensed in 2001 with an investment capital of USD 120 million which was increased to over USD 301 million now. After 12 years of operation, the firm had not paid a single penny of corporate income tax due to its constant losses mounting to VND 1,657 billion even though its revenues grew 24 times with a network of 19 wholesale centers in 16 cities and provinces nationwide. From 2003 to 2011, the firm was inspected by tax authorities four times and was forced to cut its losses by over VND 500 billion. Last August, the firm announced its plan to sell its retail chain to Thai Berli Jucker (BJC) at USD 879 million, almost triple its investment capital.

The case of Metro was a costly lesson for management authorities, said Dr Nguyen Mai, a foreign direct investment specialist, pointing to management agencies’ responsibility to inspect and supervise businesses to prevent them from taking advantage of loopholes for profit-seeking purposes.

Dr Pham Tat Thang from the Ministry of Industry and Trade agreed it was partly the fault of management authorities when allowing loss-making businesses to expand operations without inspecting their losses.

Vu Vinh Phu, head of the Supermarket Association, said tax authorities must be responsible for businesses’ fulfillment of tax obligations, pointing out, in the case of Metro, tax agencies had failed to promptly conduct inspection as the firm had reported losses for over 10 years. Vietnam lost lock, stock, and barrel when offering foreign investors major incentives, which put domestic businesses at a disadvantage, without gaining tax revenues, he said.

Foreign tax violators must be strictly penalized, given numerous incentives they have been endowed, Dr Le Dang Doanh, former director of the Central Economic Research Institute, said, praising the publicity of Metro inspection results as a step forward to uncover foreign investors’ tax violations. He said tax authorities should expand international cooperation and improve tax administration skills to create a fair business environment in Vietnam, avoiding turning the country into a fertile land for foreign investors to make unlawful riches.

Metro was just a name on the list of foreign-invested businesses which continually reported losses but still expanded business with impressive revenue growth. In 2013, 122 businesses were detected to conduct transfer pricing and forced to pay tax arrears worth VND 200 billion. Of them, South Korea’s Keangnam Vina alone had to pay taxes totaling VND 100 billion and Malaysian-owned Hualon Corporation, VND 78 billion.

By August 2014, tax authorities had scrutinized over 39,6000 businesses and found transfer pricing at over 1,900 businesses, forcing violators to pay over VND 1,317 billion in tax arrears and cut losses by nearly VND 4,200 billion. This year, about 15-20 percent of loss-reporting businesses showing signs of transfer pricing will be inspected.- (VLLF)