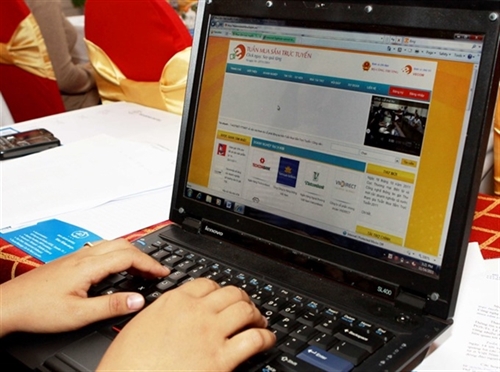

Vietnamese e-commerce is growing, creating many opportunities to generate jobs, develop the private sector economy and increase revenue for the State budget. However, preventing tax losses in this business requires improving mechanisms and policies.

Data published by the Vietnam E-commerce and Digital Economy Agency (IDEA), Ministry of Industry and Trade, showed that the average growth rate of retail e-commerce revenue reached 17 percent per year in 2020 and last year, with total revenue of USD 13.7 billion, accounting for 7 percent of sales of consumer goods and services nationwide last year.

|

| A shopper buys goods online__Photo: VNA |

In particular, the pandemic period has helped create online shopping habits, especially in big cities.

Lai Viet Anh, IDEA’s deputy director, said that the growth rate of Vietnam's e-commerce was forecast to reach about 17 - 20 percent this year, bringing retail e-commerce revenue to over USD 16 billion, which is expected to account for about 7.5 percent of sales of consumer goods and services nationwide.

Economic experts said that given the growth of e-commerce transactions, stricter tax collection management both in breadth and depth for this type of business was necessary.

E-commerce transactions can be done between business to business, between businesses and individuals, and between individuals and individuals.

However, the nature of e-commerce is that there is no transaction office, no paper-based transactions, and some of the goods exchanged in the transaction are intangible goods such as digital products.

Therefore, transactions in e-commerce are often difficult to control, manage, monitor, and access information on, according to Anh.

In addition, tax evasion is more frequent and common, causing difficulties for tax administration, and the annual budget can lose a significant amount from e-commerce.

In order to improve the effectiveness of tax administration for e-commerce activities, a representative of the National Institute for Finance (Ministry of Finance) said that it was necessary to ensure the principle of fairness between the traditional business and e-commerce business.

In particular, tax mechanisms and policies must create favorable conditions for e-commerce activities to develop, without creating barriers for consumers.

“Tax policy for e-commerce should aim to be simple, easy to implement and reduce compliance costs for businesses, on the one hand, and not become a barrier to the development of the digital economy in general and e-commerce in particular, on the other hand, while still ensuring correct and sufficient tax collection for the State budget," said the representative.- (VNS/VLLF)