1. Law on Cyber Security

Passed on June 12 and set to take effect on January 1 next year, the Law on Cyber Security prescribes activities of protecting national security and ensuring social order and safety in cyberspace and responsibilities of related agencies, organizations and individuals.

The 43-article Law adheres to the principle that the performance of the tasks of protecting cyber security and information systems of national security importance must be closely combined with socio-economic development, guarantee of human rights and citizens’ rights, and facilitation of operation of agencies, organizations and individuals, including also foreign entities, in cyberspace.

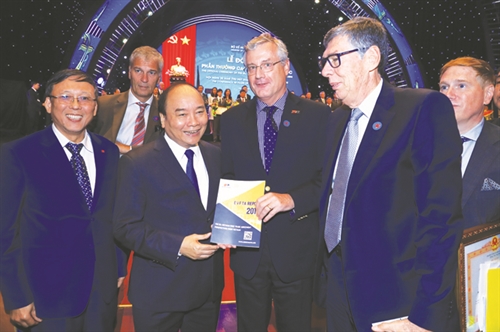

|

| The session on cyber security held within the framework of the World Economic Forum on ASEAN 2018 in Hanoi on September 12__Photo: Nguyen Khang/VNA |

The Law requires domestic and foreign enterprises providing services in telecommunications networks or the Internet or providing value-added services in cyberspace in Vietnam that collect, exploit, analyze and process personal information or data on relationships of service users and data created by service users in Vietnam to store these data in the country for a certain period. Particularly, foreign enterprises conducting these activities must establish branches or representative offices in Vietnam. These provisions will enhance businesses’ responsibilities for protection of users’ personal data while creating an equal business environment between domestic enterprises and their foreign rivals.-

2. Anti-Corruption Law

The Law was passed on November 20 and scheduled to replace the 2005 Anti-Corruption Law and its 2007 and 2012 amendments from July 1, 2019.

Compared to the current law, the scope of regulation of the Law is extended to cover also the non-state sector. In order to facilitate the application of the Law to the non-state sector, three types of corrupt acts committed by persons holding positions and powers in enterprises and non-state organizations are clearly specified, including embezzlement, taking bribes, and giving bribes or brokering bribery.

The Law also has some changes in declaration of incomes and assets. Under the Law, a declarant must declare not only his own property and incomes but also those of his spouse and minor children. Regarding persons obliged to make income and assets declarations, the Law makes it clear by stipulating in detail who must make declaration and what type of declaration is required - initial declaration, supplementary declaration or annual declaration.

Noteworthily, while removing some subjects from the list of those required to make annual declaration of incomes and assets, the Law adds police and army officers to the list of persons subject to initial declaration.

The Law also stipulates that if competent authorities can prove the origin of assets acquired through corrupt practices, they will recover or confiscate such assets. If detecting signs of tax evasion, they will handle the cases in accordance with the tax law.-

3. Guiding texts of the Law on Foreign Trade Management

In 2018, six decrees guiding the Law on Foreign Trade Management were issued by the Government. They are: Decree 09 on goods purchase and sale activities of foreign investors and foreign-invested enterprises in Vietnam; Decree 10 on safeguard measures; Decree 14 on border trade; Decree 28 on foreign trade development measures; Decree 31 on origin of goods; and Decree 69 providing general guidance on the implementation of the Law.

Together with the Law on Foreign Trade Management, these six decrees form a complete legal framework for state agencies to effectively manage foreign trade activities in Vietnam while facilitating operations of traders, including also foreign ones.-

4. Government Decree 51/2018/ND-CP detailing the Commercial Law regarding goods purchase and sale through goods exchanges

Issued on April 9, the Decree revises some articles of Decree 158 of 2006 and is expected to create a more convenient business environment for foreign investors.

Specifically, it allows foreign investors to contribute capital to establish or hold up to 49 percent of shares or charter capital of a Vietnam-based goods exchange.

|

| Conducting export transactions via Vietnam Goods Exchange in Ho Chi Minh City__Photo: Internet |

In addition, foreign investors may participate in goods purchase and sale through goods exchanges as customers or act as members of goods exchanges without being subject to any charter capital holding cap.

The Decree came into force on June 1.-

5. Government Decree 63/2018/ND-CP on investment in the form of public-private partnership

Dated May 4, the Decree specifies incentives for PPP projects, aiming to lure more investors into these projects.

Under the Decree, which replaces Decree 15 of 2015, from June 19, project enterprises of PPP projects are entitled to corporate income tax incentives in accordance with the law on corporate income tax. Meanwhile, goods imported for project implementation are eligible for incentives under the law on import duty and export duty.

Besides, project owners may enjoy land use levy exemption or reduction for land areas allocated by the State or land rental exemption or reduction during the project implementation in accordance with the land law.-

6. Government Decree 86/2018/ND-CP on foreign cooperation and investment in education

According to the Decree, which was issued on June 6, a foreign education program may be integrated into a Vietnamese program if satisfying the following requirements:

• Having been accredited in terms of educational quality in the home country or recognized in terms of educational quality by a competent education agency of the home country;

• Ensuring its consistency throughout the educational level and the transferability between educational levels;

• Ensuring voluntary participation by and not causing overload on students;

• Ensuring the objectives of the Vietnamese education program and satisfying the requirements of the foreign education program; and,

• Being approved by a Vietnamese competent agency.

The Decree took effect on August 1, replacing Decree 73 of 2012 and Decree 124 of 2014.-

7. Government Decree 108/2018/ND-CP on enterprise registration

Issued on August 23, the Decree, which replaces Decree 78 of 2015, is designed to simplify enterprise registration procedures.

|

| The French Cultural Center L’Espace in Trang Tien street, Hanoi__Photo: Internet |

Specifically, from October 10, the effective date of the Decree, enterprises are no longer required to append their seals on papers in enterprise registration dossiers such as request for enterprise registration, notice of change in enterprise registration contents, resolution, decision, and minutes of meeting. Meanwhile, a power of attorney for a person carrying out enterprise registration procedures is not necessary to be notarized or certified.

To help enterprises save costs and time, the Decree allows them to set up business locations anywhere at their convenience, instead of requiring them to carry out procedures for establishing branches as prescribed in Decree 78.-

8. Government Decree 126/2018/ND-CP on establishment and operation of foreign cultural institutions in Vietnam

Under the Decree, which was issued on September 20 and took effect on November 5, Vietnam-based foreign cultural institutions may organize activities in the fields of culture and arts, including exhibition; art performance; film screening; art creation contests; organization of creation camps; festivals and festive events; events on the occasion of public holidays and anniversaries; conferences, seminars, consultations, talks, lectures; clubs; and training in culture and arts. However, they must notify the operational contents to the Ministry of Culture, Sports and Tourism and provincial-level People’s Committees of the localities where the activities are expected to be organized.

|

| Vietnamese pupils with their foreign teacher during a lesson__Photo: Internet |

Vietnam-based foreign cultural institutions may rent land and houses for use as head offices and vehicles and equipment serving their operation and daily-life activities; employ Vietnamese citizens and citizens of third countries; and open foreign-currency and Vietnam-dong accounts at commercial banks. However, they can neither provide guarantee nor apply for visas for those who are not engaged in their operation in Vietnam to enter the country.-

9. Government Decree 143/2018/ND-CP on the compulsory social insurance regime applicable to foreigners working in Vietnam

Issued on October 15, the Decree details the Law on Social Insurance and the Law on Occupational Safety and Health regarding compulsory social insurance for employees being foreign citizens working in Vietnam.

As from December 1, the effective date of the Decree, foreigners working in Vietnam are required to comply with the following compulsory social insurance regimes: sickness; maternity; and occupational accident and disease.

As per the retirement and survivorship regime, which will be applied from January 1, 2022, the Decree stipulates that a foreign worker will monthly pay an amount equal to 8 percent of his monthly salary to the retirement and survivorship allowance fund. In case he has neither worked nor received salary for 14 working days or more in a month, he will not be required to pay social insurance premiums for that month and that month will be excluded from the period of premium contribution which will be used as a basis for calculation of insurance benefits.

A foreign worker may receive one-off social insurance allowance if he so requests and falls into one of the following cases: (i) having reached the prescribed retirement age but not yet paid social insurance premiums for full 20 years; (ii) suffering a fatal disease; (iii) fully satisfying the conditions for pension entitlement but no longer residing in Vietnam; and (iv) having his request for extension of labor contract, work permit, practice certificate or practice license rejected.-

10. Prime Minister Decision 1489/QD-TTg on attraction, management and use of official development assistance (ODA) and concessional loans of foreign donors during 2018-20, with a vision for the 2021-25 period

As per the Decision, which is signed on November 6, during 2018-20, ODA loans will only be used for some particular fields and projects. For example, specialized fields serving as the foundation for the development of other sectors such as riverports and seaports, projects falling beyond the capacity of the domestic public investment capital sources, and unattractive or unprofitable projects. In addition, ODA and foreign concessional loans will only be spent on development investment and must not be used to cover current expenditures.

In order to bring into full play positive effects of these foreign capital sources, the Decision says that every new loan taken in the 2021-25 period will be considered in terms of economic efficiency, financial plans, impacts on medium-term public investment plans, public debt and budget indicators, and debt repayment capacity.

Noticeably, the Decision says that capital from the sources of ODA capital and foreign concessional loans will be regarded as a financial leverage to attract investment from the private sector, thus gradually reducing the proportion of foreign loans to total investment of projects. In this light, ODA and foreign concessional loans will not be used for projects which private businesses are interested in and can implement with more advanced technologies and lower costs.- (VLLF)