Many large firms have shown their interest in Vietnam, and the country is looking at its chances to welcome large-scale foreign direct investment (FDI) inflows.

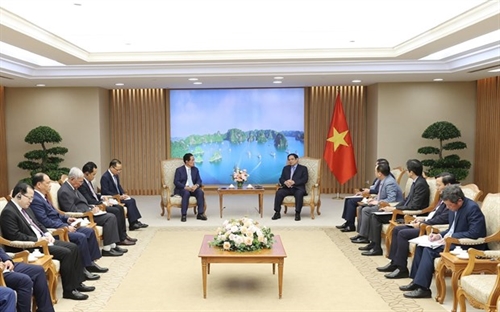

A delegation of 25 member companies of the Automotive Component Manufacturers Association of India (ACMA) has paid a business trip to Vietnam to explore the country’s investment and business opportunities. ACMA groups 800 makers of auto parts and components that contribute more than 85 percent to the revenue of the Indian auto industry.

Yuvraj Kapuria, President of YBLF - a member of ACMA, said that ACMA wants to cooperate with businesses in the Vietnamese automobile industry to jointly explore new markets through all forms of cooperation.

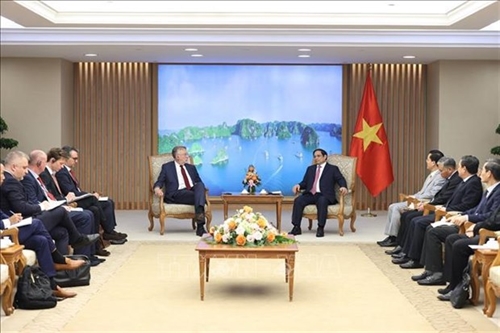

Recently, Yerkin Tatishhev, founder and chairman of Kusto Group, also visited Vietnam after a three-year hiatus due to the COVID-19 pandemic. Following a 10-day trip with many meetings with Vietnamese officials and businesspeople, Tatishhev plans to expand investment in Vietnam, after having invested more than USD 1 billion in 10 projects in Vietnam over the past 15 years. Kusto Group’s two fields of interest are social housing and infrastructure projects.

Kusto Group is likely to invest up to hundreds of millions of USD in Vietnam in the near future if projects meet the group's criteria and business philosophy.

The southern province of Binh Duong was among the places Tatishhev visited to look for investment opportunities. A few days ago, Robert Wu, Chairman and CEO of Sharp Corporation (Japan), also paid a visit to this locality.

Wu said that his firm will continue to expand production and business facilities in the southern industrial hub. He noted that Vietnam's economy is expected to accelerate after the pandemic, while the Vietnamese government is also giving more incentives to foreign businesses.

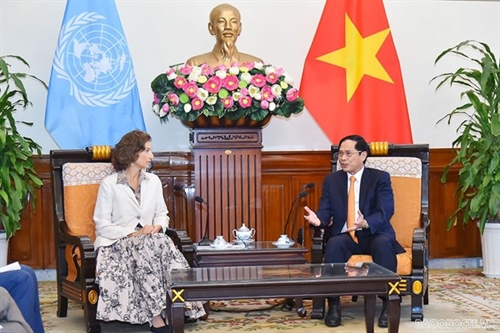

SK Group, a company from the Republic of Korea (RoK) - has even bigger ambitions in the Vietnamese market.

During an online exchange with Minister of Planning and Investment Nguyen Chi Dung and Minister of Industry and Trade Nguyen Hong Dien in mid-August, Chey Tae-won, Chairman of SK Group, said the group is considering conditions to invest in hydrogen projects in the Mekong Delta and high-tech projects using clean energy in Vietnam.

As the second largest corporation in the RoK, SK Group has inked many large investment deals in Vietnam, including pouring USD 470 million to buy a 9.4 percent stake in Masan Group, USD 1 billion to get a 6 percent stake in Vingroup, and USD 340 million into TheCrownX. According to some sources, it is most likely that SK will inject capital into the Pharmacity drugstore network in Vietnam.

Deputy Director of the Department of Foreign Investment under the Ministry of Planning and Investment Nguyen Anh Tuan attributed the results to Vietnam's good control of the COVID-19 pandemic, its advantages in terms of human resources and domestic market, and the determination to improve the investment and business environment.

However, Minister of Planning and Investment Nguyen Chi Dung said Vietnam needs to do more to tap FDI opportunities, including designing a proper response policy and preparing land, resources, personnel and infrastructure.- (VNA/VLLF)