Pham Thi Hong Dao

Thanh Hung Lawyers’ Office

E-commerce is basically the application of electronic means to business and commercial activities. The development of the Internet and its universal use have paved the way for the growth of online business activities and brought about huge benefits to business entities. When participating in e-commerce, entities must comply with not only direct regulations on e-commerce but also relevant investment, commerce and civil laws. Therefore, the building and completion of a legal framework on e-commerce has become imperative. E-commerce legislation is regarded as a tool to protect and direct business entities and create a sound business environment through e-commerce.

According to Vietnam’s overall plan on e-commerce development from 2016 to 2020, by 2020, 50% of enterprises will have websites and 80% of enterprises will place or receive orders via e-commerce applications.

Current legal framework on e-commerce

Three laws that lay the legal foundation for e-ecommerce were passed in 2005, including the Commercial Law, the Civil Law and the Law on E-transactions. E-commerce activities and the settlement of disputes in e-ecommerce are also governed by various laws, such as the 2006 Law on Information Technology, the 2009 Telecommunications Law, the 1999 Penal Code (amended in 2009), the 2010 Law on Protection of Consumer Interests, the 2012 Advertising Law, the 2014 Law on Investment, and the 2014 Law on Enterprises.

Besides, in order to guide and manage transactions and activities related to e-commerce and the handling of violations in e-commerce, the Government and ministries have issued dozens of decrees and circulars. The important and new contents of some of these decrees and circulars are discussed below.

Principles of e-commerce activities

Government Decree No. 52/2013/ND-CP of May 16, 2013, on e-commerce establishes four principles for e-commerce activities.

The first principle is free and voluntary agreement in e-commerce deals. Accordingly, entities participating in an e-commerce transaction are free to reach agreement that is not contrary to law to establish the rights and obligations of each party in the transaction. This agreement serves as a ground for the settlement of disputes that may arise in the course of carrying out the transaction.

Second is the principle of determination of the scope of business in e-commerce. If traders, organizations or individuals that sell goods, provide services or promote trade on e-commerce websites do not announce specific geographical limits of these activities, such activities will be regarded as being carried out on a national scale.

Protection of consumer interests is the third principle, which requires owners of e-commerce sale websites and sellers on e-commerce service websites to comply with the Law on Protection of Consumer Interests when providing goods or services to customers. Customers on e-commerce service websites are users of e-commerce services and consumers of goods and services provided by the sellers on these websites. If the sellers directly post information about their goods and services on e-commerce websites, then the providers of e-commerce services and the suppliers of infrastructure are not the third party providing information as prescribed by the Law on Protection of Consumer Interests.

The last principle relates to e-commerce in goods and services restricted from trading or subject to trading conditions. This principle requires entities applying e-commerce to trade in goods and provide services restricted from trading or provision or subject to business conditions to strictly observe relevant regulations on the trading in those goods and provision of those services.

|

Relevant regulations concerning e-commerce

The 2014 Law on Investment has many new provisions that ensure an open legal corridor for attracting investment and a transparent business investment environment to guarantee the interests of investors and business people and bring the best benefits for socio-economic development. The most significant provisions in the Law deal with citizens’ freedom of investment and business in all sectors and trades not prohibited by law or subject to business and investment conditions prescribed by law.

Meanwhile, the 2014 Law on Enterprises manifests the spirit of the 2013 Constitution on freedom of business. The Law separates enterprise establishment procedures from project investment and investment certification procedures, thus giving greater market access to enterprises. It lifts the requirement on an enterprise to provide a sector code when making business registration. Enterprises are not entitled to autonomy in doing business and deciding on forms of business organization. They also have the freedom to select business lines, places and forms as well as change their business scale and lines.

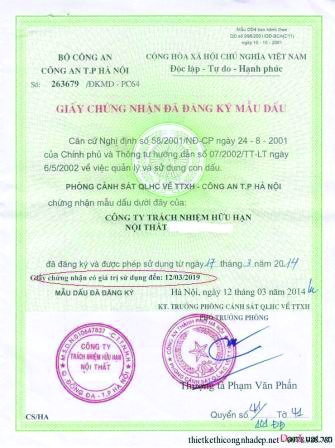

The development trend of e-transactions has resulted in changes in the use of seals. The Law on Enterprises permits enterprises to decide on the form, quantity and content of their seals in accordance with law. But they are obliged to notify their specimen seals to the business registration agency for announcement on the National Business Registration Portal. Not all documents of an enterprise must bear seals, but only those which are required by law or by the enterprise’s partners to be affixed with seals.

Government Decree 124 of 2015 (Clauses 32 thru 35 of Article 1) lists administrative violations in e-commerce activities and sets fine levels for such violations.

Under this Decree, for violations in the establishment of e-commerce websites or e-commerce applications on mobile devices (mobile applications), a fine of VND 20-30 million will be imposed on those (i) establishing e-commerce service provision websites or e-commerce service applications without making registration with competent state management agencies as prescribed; (ii) receiving the transfer of e-commerce service provision websites or e-commerce service applications without carrying out transfer procedures or without re-registering with competent state management agencies as prescribed; (iii) providing e-commerce services not stated in the registration dossier; (iv) committing fraud or providing untruthful information upon registration of e-commerce service provision websites or e-commerce service applications; (v) forging information registered on e-commerce service provision websites or e-commerce service applications; or (v) continuing to provide e-commerce services after the registration termination or cancellation.

This fine level also applies to violations of regulations on protection of personal information in e-commerce activities, such as collecting personal information of consumers without their prior consent; setting defaults to compel consumers to agree with the sharing, disclosure or use of their information for advertising and other commercial purposes; or using personal information of consumers against the notified purpose and scope.

For violations of regulations on information and transactions on e-commerce websites or mobile applications, a fine of VND 30-40 million will be levied on those forging or copying e-commerce website interfaces or mobile applications of other traders, organizations or individuals to gain profits, cause confusion or make customers distrust these traders, organizations or individuals; or on those stealing, disclosing, transferring or selling information relating to business secrets of other traders or organizations or personal information of consumers in e-commerce without their consent.

Circular No. 47/2014/TT-BCT on management of e-commerce websites, which was issued on December 5, 2014, by the Ministry of Industry and Trade (MoIT), clarifies the provisions of Decree 52 on management of business activities on e-commerce websites. It assigns responsibilities for management of specialized websites and regulates the trading in goods restricted from trading or goods and services subject to business conditions on e-commerce websites, and the management of e-commerce activities in social networking sites.

This Circular does not apply to websites operating in the fields of finance, banking, credit, insurance, purchase, sale and exchange of money, gold, foreign currencies and other payment instruments, or providing online games, betting or prize-winning games.

Concerning the management of business activities on social networking sites, Circular 47 says owners of sites that allow participants to establish sub-websites or to open stalls for display and introduction of their goods or services and owners of sites that have sections permitting participants to post information about goods and service purchase and sale, must register these activities via the e-commerce exchange.

The Circular disallows traders, organizations or individuals to trade in goods restricted from trading on e-commerce sale websites or e-commerce service websites, and bans individuals from trading in goods and services subject to business conditions. Meanwhile, traders and organizations may establish e-commerce sale websites to trade in goods and services subject to business conditions but must publish on their websites the serial number and date and place of issuance of their certificate of eligibility for trading in such goods and services (if this certificate is required by law). They may use e-commerce service websites for selling goods and services subject to business conditions provided that they meet the required conditions for trading in such goods and services. In this case, the owners of these websites must request the sellers to produce their business eligibility certificate and, when discovering or receiving reports that information about goods sale and service provision violates law, will remove such information from their websites.

Circular 39 issued on December 11, 2014, by the State Bank of Vietnam clearly defines types of payment intermediary services and regulates the provision of these services, including risk management, safety and security assurance and solvency assurance. Under this Circular, those wishing to provide payment intermediary services must establish and apply principles of risk management in e-banking activities. They have to ensure safety and security for their information technology systems in banking activities as well as for the provision of e-banking services. They must also comply with the provisions of the law on e-transactions regarding issuance, use, preservation and storage of e-documents in banking activities.

Some inadequacies and proposals

Vietnam is establishing a legal corridor for e-commerce transactions to be conducted in a transparent and competitive manner, thus facilitating the development of e-commerce and contributing to increasing the competitiveness of enterprises and forming modern commercial practices in the country. However, in order to control e-commerce business more strictly without causing difficulties to entities participating in this activity, it is necessary to study and overcome the following problems.

First, in addition to e-commerce websites, social networking sites, especially Facebook, have become very popular in Vietnam. At present, the number of people using social networking forums for online shopping is increasing. So is the number of enterprises using mobile devices as a channel of liaison between retailers and consumers. Therefore, the management of social networking sites engaged in e-commerce and of mobile devices has become urgent. Besides, responsible authorities have not yet issued clear regulations on the list of e-commerce websites which consumers should be cautious about. Neither have they worked out detailed guidelines on the process of entering into online goods purchase contracts as well as necessary warnings for people using this service. Section 2 of Decree 52 has 8 articles on the process of entering into a contract between an online seller and an online buyer. Article 23 of this Decree assigns the MoIT to issue details of the process of online conclusion of contracts on e-commerce websites developed by traders, organizations or individuals to purchase goods and services. But so far such detailed guidance remains unavailable.

|

| Goods sold on the Lazada online shopping site at competitive prices __Photo: VLLF |

Second, the current law permits the MoIT to publicly announce on the e-portal on management of e-commerce activities a list of e-commerce websites which are reported to show signs of violation. The question is whether this is a measure of management to facilitate business activities or just a pretext for unfair competition to appear. These regulations do not restrict those who are eligible to report on websites showing sign of violation, neither do they provide a process for verifying these reports, so they are prone to abuse by competitive rivals.

Third, Circular 47 of the MoIT requires that companies that have sale websites or social networking sites register them on the e-exchange and social networking sites manage information and activities of their subscribers. All e-commerce activities must be registered with the MoIT’s Vietnam E-Commerce and Information Technology Agency (VECITA). Tax agencies may use information from VECITA to monitor enterprises and organizations that have e-commerce service websites and their cooperation contracts and agreements in order to collect taxes. Through these activities, tax agencies can check documents relating to these enterprises’ revenues and expenditures. Information from the data on the registration of e-commerce activities will be the basis for tax agencies to grasp business activities carried out via the e-commerce exchange, especially the cases of online product stores opened by individuals and enterprises, so as to apply tax administration measures. At present, however, not many enterprises have registered with VECITA. The reason is that this Circular stipulates the registration responsibility of enterprises but does not clearly define examination and supervision duties of competent state agencies. So, many enterprises “shirk” the registration responsibility and get away without being handled. This is also a reason for the loss of tax revenues because of the unavailability of data on e-commerce activities for tax calculation. Under the 2006 Tax Administration Law (amended in 2012 and 2016), organizations and individuals must pay tax when carrying out commercial activities, earning remuneration or buying and selling properties, regardless of whether such trading transactions are carried out conventionally or electronically. Yet, most individuals selling products on e-commerce websites do not declare their activities and pay tax. Even many enterprises doing online business have no clear business locations and bank accounts. Not a few enterprises and individuals owning sale websites do not notify to VECITA and do not declare taxes.

Fourth, the resolution of disputes in e-commerce activities is now governed by the 2015 Civil Procedure Code. According to Clause 3, Article 95 of this Code, “electronic data messages expressed in the form of exchange of electronic data, electronic documents, emails, telegraph, telex, fax and other similar forms as prescribed by the law on electronic transactions” can be regarded as evidence. Form this provision, it can be inferred that electronic evidence is evidence stored in the form of electronic sign in computers or devices with digital memories and relating to a dispute. Electronic evidence may be collected for use as proof, including:

- Electronic evidence automatically created by computers such as cookies, URL, email logs and web server logs;

- Electronic information created by human beings and stored in computers or other electronic devices, such as texts, tables, images, information, etc., in the form of electronic signal.

In collecting these electronic traces, it is necessary to have appropriate computer techniques and technologies and software to restore those which have been deleted or overwritten so that they can be read or recorded in a readable form for use as legal evidence at court.

However, the Civil Code does not provide methods of collecting such electronic evidence, procedures for collecting and the rights of related entities in collecting electronic evidence. To facilitate the collection of electronic evidence under a court’s order, the law should provide:

- The right to request supply of computer data; the right and procedures to collect and retain electronic evidence from internet service providers and computer owners;

- The right to request provision of information in computers in tangible and readable forms. This is a very important issue for authorities when they, for some reason, do not have devices to collect information and convert digital information into a readable or audible form;

- The right to access and get data for use as electronic evidence;

- The duty to preserve electronic data already transmitted via the computer network, especially those that can be deleted or modified, for 90 days at most, for competent authorities to search and get information relating to disputes;

- The right to request provision of subscriber information, accessed information, call information and other information relating to disputes by telecommunications and internet service providers.

Fifth, it is necessary to consider using prestige labels as a business condition in e-commerce so as to restrict unsafe and cheating e-commerce websites.

Sixth, to prevent hackers from using the phishing technique, competent authorities should consider issuing regulations to urge Vietnamese enterprises to buy satellite domain names closely related to their main domain names as a security measure to protect consumer interests in e-commerce.

In summary, in order to further boost e-commerce and create favorable mechanisms for the resolution of disputes in e-commerce, Vietnam needs to issue regulations on the legal validity of e-evidence; methods of managing social networking sites engaged in e-commerce business as well as mobile devices; imposes penalties corresponding to violations; and on the collection of electronic data by competent authorities in order to timely settle disputes in e-commerce.-