Anh Thu

|

| Agribank strongly supports the fisheries sector__Photo: Agribank |

In 2023, amid global socio-economic challenges, the forestry-fisheries sector faced numerous difficulties on the international market, leading to a significant decline in material prices across most specialized farming areas nationwide. Following the Government’s and the State Bank’s instructions on implementation of solutions to tackle slowdown in this sector, the Vietnam Bank for Agriculture and Rural Development (Agribank) has always accompanied and supported enterprises in enhancing their competitiveness in exporting forest and fishery products.

Extending credit for the forestry-fisheries sector

The implementation of credit solutions to develop agriculture in general and the forestry-fisheries sector in particular is crucial. These solutions aim not only to address difficulties and boost growth but also to lay a firm foundation for sustainable and green development and improvement of hi-tech content of this sector in alignment with the socio-economic development strategy for the 2020-25 period, with a vision toward 2030.

Agribank, as a major commercial bank operating largely in the field of rural finance, maintains a ratio of loans for agriculture, rural areas and farmers consistently at 65-70 percent of its total lending. Its loans have reached all communes nationwide, contributing to intensifying economic restructuring in agriculture and significantly supporting the building of a new-style countryside.

In furtherance of the State Bank’s policy on implementation of the credit program for the forestry-fisheries sector as instructed by the Prime Minister (with a loan amount of VND 15 trillion), and policy on continued implementation of the credit program for the forestry-fisheries sector with the loan amount increased to VND 30 trillion, Agribank has promptly issued a credit program worth VND 3 trillion for the forestry-fisheries sector. By November 30, 2023, Agribank had disbursed loans totaling VND 3 trillion as committed. It has also asked for the State Bank’s permission for increasing the loan for the forestry-fisheries sector to VND 8 trillion (almost 30 percent of this sector’s total loans). To date, around 90 percent of loans under the credit program has been disbursed with an amount reaching VND 6.8 trillion.

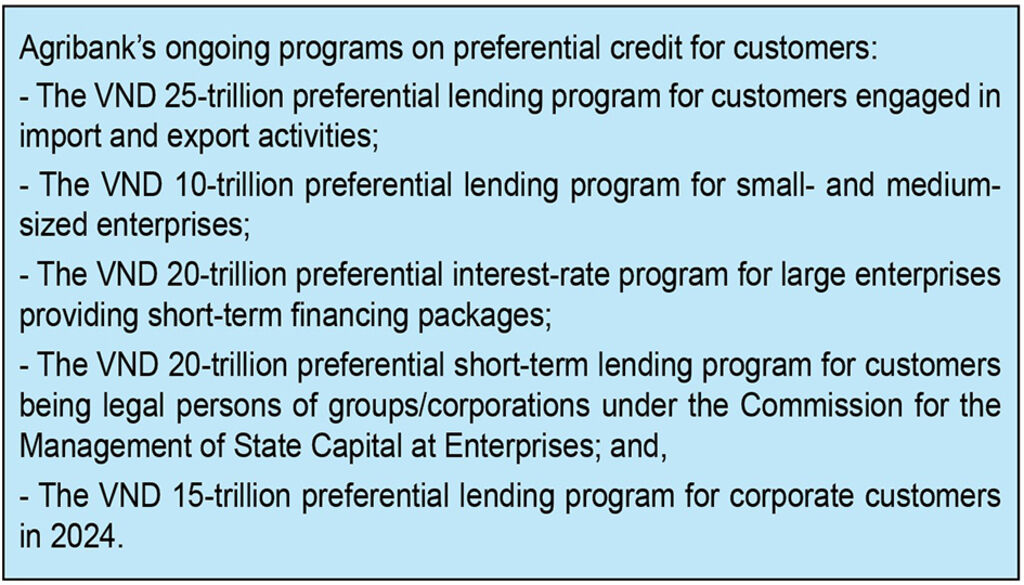

Moreover, Agribank is proceeding with provision of loans for the forestry-fisheries sector under the State Bank’s VND 30 trillion package and concurrently implementing numerous programs on provision of concessional loans to promote the development of the forestry-fisheries sector as well as other priority areas that drive national economic growth (consumption, export, investment, etc.).

Since the beginning of 2024, Agribank has set aside over VND 230 trillion for implementation of preferential interest rate programs in support of citizens and businesses (with the average interest rates of 5-7 percent, and the lowest interest rate of 3 percent). Additionally, customers engaged in the field of agriculture and rural development and evaluated as having a transparent and healthy financial status will be entitled to a short-term preferential interest rate of 4 percent under the State Bank’s regulations. In addition, Agribank has cut by half some service charges payable by borrowers.

At a workshop titled “Providing loans to help the forestry-fisheries sector maintain their billion-dollar export turnover” held by Lao Dong (Labor) Newspaper on April 12, Phung Thi Binh, Agribank’s Deputy General Director, said: “Agribank’s provision of loans to the forestry-fisheries sector has yielded positive results. However, during the realization of the lending model based on agricultural value chains, we have encountered not a few challenges and obstacles. The biggest challenge in developing value chains is the lack of financially capable enterprises to lead in such chains’ activities. Localities have not yet adopted complete policies on building value chains while not involving the active participation of related sectors. Linkage agreements are frequently breached by farmers and enterprises, making it difficult for the bank to control the cash flow. At the same time, there is no legal basis for resolution of disputes and no effective measure for raising the sense of responsibility of farmers and enterprises to perform the signed agreements”.

|

| Phung Thi Binh, Deputy General Director of Agribank__Photo: Agribank |

Credit growth solutions

In order to facilitate safe and efficient credit growth, thereby helping customers survive difficult times and improve their access to credit facilities, Agribank has set certain objectives and solutions for the coming period. These include:

(i) Maintaining and focusing on lending policies for agriculture and rural development and other priority sectors as directed by the Government and State Bank;

(ii) Meeting the capital demand for agriculture and rural development, particularly loans for the forestry-fisheries sector;

(iii) Continuing to apply preferential loan interest rates for agriculture and rural development in general and for the forestry-fisheries sector in particular;

(iv) Expanding strategic cooperation relationships with large enterprises and economic groups;

(v) Effectively implementing agreements signed between Agribank and its partners and customers;

(vi) Proactively taking part in building and connecting stages of the agricultural value chain, from farming, procurement, processing to export, in order to ensure adequate capital amounts for each stage, cash flow control and financial transparency;

(vii) Providing credit aimed at production and deep processing of agricultural products to improve their value and quality based on large-scale and hi-tech agricultural production and implementation of production and business projects up to international standards on environmental protection;

(viii) Applying technological achievements in lending activities to gradually simplify lending procedures; and,

(ix) Diversifying credit products so as to increase capital access for individual and corporate customers.-

|