Nguyen Quynh Anh[1]

CS Wind Vietnam, a Korea-invested company which manufactures wind towers in Phu My, Ba Ria-Vung Tau southern province and supplies them to customers in Europe and the US, has recently won several issues before the US Court of Appeals for Federal Circuit (CAFC) in its ongoing fight against US antidumping duties.

On August 12, 2016, the CAFC issued its judgment on CS Wind Vietnam’s appeal against the ruling of the lower Court, the Court of International Trade, New York (CIT). The CIT case was brought to contest the Department of Commerce’s (DOC or Commerce) final determination in the antidumping proceedings on exports of utility scale wind towers from Vietnam to the US market. Out of three issues before the appellate Court, CS Wind prevailed on one issue and convinced the superior Court to vacate the CIT’s decision and remand for a redetermination to the DOC on another issue.

Following is a brief history of the case. In January 2012, pursuant to a petition filed by the US Wind Tower Trade Coalition (WTTC), an antidumping investigation on utility scale wind towers from Vietnam was initiated by the DOC. The objective of the antidumping investigation was to determine if the Vietnamese exporters had sold wind towers to US customers at prices that were lower than the “fair market value” of such goods. Since Vietnam is considered a non-market economy (NME) in US antidumping proceedings, the DOC disregards the price charged by the exporter for selling like product in the Vietnamese market for purposes of fair market value. Instead, the DOC establishes fair value of goods by aggregating the cost of all materials and non-material inputs utilized in the production of subject merchandise, based on the price data prevailing in a surrogate country (i.e. an economically comparable country that is also a significant producer of comparable merchandise). In this proceeding, the DOC selected India as a surrogate country to Vietnam.

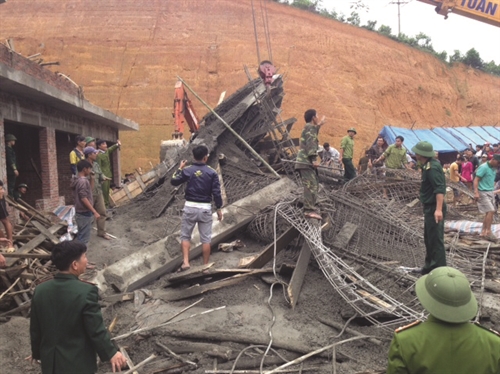

|

| Wind turbines in Bac Lieu province __Photo: Thanh Liem/VNA |

Being the largest exporter of subject merchandise to the US market, CS Wind, located in Phu My Industrial Park No. 1, Tan Thanh district, Ba Ria-Vung Tau province, was selected as a mandatory respondent for detailed examination by the DOC. At the agency, and later in court, CS Wind was represented by a team of lawyers from the law firm, Grunfeld, Desiderio, Lebowitz, Silverman & Klestadt (GDLSK). The antidumping case was prosecuted before the agency for one full year, in the course of which CS Wind submitted a large amount of proprietary data, public domain information, detailed arguments and rebuttal arguments in order to convince the DOC that it had not dumped wind towers in the US market. However, the DOC was largely unpersuaded by CS Wind and imposed a high antidumping duty - 52.67% (in the preliminary determination issued in July 2012) and 51.5% (in the final determination issued in December 2012). On account of such prohibitively high levels of antidumping duties, CS Wind was unable to export its wind towers to the US market after July 2012.

CS Wind promptly challenged the agency’s determination before the lower Court, CIT, in early 2013. Over a period of two plus years, CS Wind filed several legal briefs and made oral arguments before the lower Court and laid out its case in detail. The CIT agreed with CS Wind on a number of major issues and remanded the matter twice to the DOC for reconsideration, prompting CS Wind to file additional briefs before the agency during the remand proceedings. Ultimately, in its decision of May 2015, the CIT agreed with CS Wind on several issues, most notably, the valuation of steel plate, a primary input in wind towers. As a result, CS Wind’s antidumping duty dropped precipitously from 51.5% to 17.02%. This was indeed a significant victory for CS Wind. Even so, the CIT ruled against CS Wind on three issues - weight adjustments, market economy purchases from Korea and financial ratios.

Consequently, CS Wind challenged the lower Court’s decision before the appellate Court, the CAFC. Again, CS Wind filed extensive briefs before the superior Court and argued before a panel of three judges. In its ruling of August 12, 2016, the CAFC agreed with CS Wind on two out of three issues. First, the superior Court ruled unambiguously in favor of CS Wind on the issue of weight adjustments. Second, the Court also set aside the lower Court’s decision on the issue of financial ratios, remanding it to Commerce for a redetermination based on the higher Court’s guidelines. By winning the weight adjustments issue, CS Wind’s antidumping duty has further dropped to low single digits.

CS Wind’s remarkable turnaround in the court litigation was the result of hard work by GDLSK lawyers based in Washington DC, New York and Hong Kong. Specifically, CS Wind’s victories on several surrogate value issues, most notably the valuation of steel plate, constitute the main reason for its success. As noted above, the DOC relied on surrogate value data from India in order to determine the fair value of goods in this proceeding. It was indeed a challenge to locate the most precise and specific price data from India to accurately value the various inputs. To that end, CS Wind’s surrogate value expert worked diligently over months in India. GDLSK was able to locate very authoritative steel price databases, including the widely published Steelguru, and supported these prices with detailed information and affidavits, which ultimately persuaded the CIT to accept it as the most suitable data for accurately valuing the steel plates used by CS Wind. Earlier, contribution of GDLSK’s surrogate value expert was notable in persuading the DOC to prefer the financial statement of an Indian wind tower company, Ganges Internationale, over several alternative financial statements proposed by the WTTC. The final issue over the valuation of the Ganges financial ratios, as remanded by the CAFC, will determine whether CS Wind escapes not only the burden of antidumping duties but is set free from antidumping proceedings altogether. As such, the surrogate value information presented by CS Wind’s counsel constitutes a pivotal reason behind the turnaround in this case. In the meantime, working with GDLSK, CS Wind has carefully restructured its US pricing and sales and obtained a 0% duty rate in a recent annual antidumping review administered by the DOC. It will, nonetheless, continue its fight in court regarding the original investigation.

CS Wind Vietnam’s success story in the antidumping case has propelled the company to the status of a leading exporter of highly specialized and customized wind energy towers and equipment to the US market. The positive outcome in this proceeding hopefully prompts other multinational heavy engineering goods producers to establish their production and US export hubs in Vietnam, infusing greater foreign investment in Vietnam and creating local job opportunities.-