In order to facilitate attraction of foreign investment in the country, the Ministry of Planning and Investment (MPI) is working on a draft decree on management of industrial parks (IPs) and economic zones (EZs) and a draft decision on special investment incentives.

|

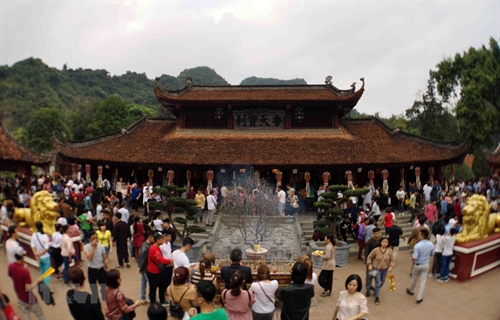

Noi Bai industrial park in Hanoi__Photo: https://www.datdothivetinhsocson.com/ |

Under the draft decree on management of IPs and EZs, the MPI proposes not requiring an IP to satisfy the condition of 60-percent occupancy rate if the total land area of the IP in a province or city is below 1,000 hectares.

As defined in Decree 82 of 2018, the occupancy rate of an IP is the proportion of its industrial land area already leased or sub-leased to investors for carrying out production and business activities to its total industrial land area.

The 60-percent occupancy rate would not also be applied to an IP in cases (i) the IP previously had an approved investment project on infrastructure construction and business operation but such project was later terminated and assigned to a new investor; (ii) investment projects on construction and business operation of IP infrastructure operate after the model of ecological, supportive and intensive IP, (iii) investors commit to reserving at least 30 percent of industrial land in IPs for hi-tech investment projects, supporting industry projects, innovation projects and projects prioritized for investment attraction.

In order to support secondary investors, the draft requires IP infrastructure investors to make re-registration of land lease rate framework with IP management boards if IP land lease rates increase by over 30 percent compared to the registered land lease rate framework. IP management boards might hold negotiations on land lease rates at the request of secondary investors who wish to rent land in IPs to carry out production and business projects.

An IP’s land area must be conformable to investment attraction ability of the province or centrally run city where it is located but must be at least 75 hectares. Besides, at least five percent of total industrial land area of an IP must be reserved for lease or sublease to small- and medium-sized enterprises, supporting industry enterprises, start-ups and other businesses eligible for production and business ground incentives and support.

In addition, incentives would be offered to investment projects on the list of sectors and trades eligible for special investment incentives in EZs. Accordingly, after having their investment policy approved or completing the selection of investors, such projects would be allowed for implementation before construction, labor and land procedures are completed. Investors would be required to make commitments on progress of completing procedures and take total responsibility for failing to comply with law-prescribed conditions and standards.

Meanwhile, the draft decision on special investment incentives proposes three levels of incentives for new and expanded investment projects that apply high technologies, make high added-value products, have pervasive impacts or are capable of connecting the global production and supply chain.

Accordingly, level-1 incentives would entitle investors to nine-percent corporate income tax (CIT) for up to 20 years, CIT exemption for at most five years and subsequent 50-percent CIT reduction for at most 10 years. Investors would also enjoy land and water surface rental break for up to 18 years and rental reduction of up to 55 percent.

If eligible for level-2 incentives, investors would enjoy seven-percent CIT within 30 years at most, CIT exemption for at most six years and subsequent 50-percent CIT reduction for up to 12 years. They would also enjoy land and water surface rental exemption for at most 20 years and up to 65-percent land and water surface rental reduction.

The most beneficial would be level-3 incentives that include five-percent CIT for up to 37.5 years, CIT exemption for six years and subsequent 50-percent CIT reduction for 13 years, plus land and water surface rental exemption for at most 22 years and a half and up to 75-percent land and water surface rental reduction.

Management agencies would base themselves on specific criteria of application of high technologies, technology transfer and percentage of Vietnamese businesses participating in domestic value chains to provide specific incentives for investment projects.

Period of application of preferential CIT rates, period of CIT reduction, and conditions for application of CIT incentives must comply with the CIT law. Tax offices would apply annual incentives based on practical conditions and specific criteria actually satisfied by projects.

In case of failing to realize commitments and satisfy conditions for application of special investment incentives, investment projects would not be entitled to incentives or have to refund incentives they have enjoyed.- (VLLF)