Phan Duc Hieu

Deputy Director - Central Institute for Economic Management

The enactment of the Company Law and the Law on Private Enterprises in 1990 marked an important milestone when the private economic sector was legally recognized in Vietnam. In 1999, these two laws were replaced with the first-ever Enterprise Law of Vietnam, which created a common legal foundation governing enterprises of all types. Since then, the Enterprise Law has been revised twice in 2005 and 2014. Recently on June 17, the Enterprise Law is once again amended into Law 59/2020/QH14. Interestingly, every time when the Enterprise Law is revised, it shows a crucial reform in business institutions, reflecting change in economic thinking and leading to strong development of enterprises and the economy as a whole.

Compared with its previous versions, the 2020 Enterprise Law (the 2020 Law) contains breakthrough changes, aiming to build a legal framework on corporate governance up to good and common practices in the region and the world; boost the development of businesses, attract capital for production and business activities; and contribute to improving Vietnam’s business environment to the level of ASEAN-4 countries.

Changing the approach to law revision

According to the Organization for Economic Cooperation and Development (OECD) Corporate Governance Factbook 2019, since 2015 when the G20/OECD Principles of Corporate Governance were issued, 84 percent of the 49 surveyed jurisdictions have amended either their company law or securities law, or both, so as to improve their legal framework on corporate governance up to the best principles. Vietnam does not stand outside of this trend. Last year, the Securities Law was revised. This June, the new Enterprise Law was adopted by the National Assembly. Worthy of note, the 2020 Law manifests a new legislative approach which is reflected in the following two aspects.

Firstly, the revision of the enterprise law is conducted in a proactive way instead of a passive manner for the purposes of not only redressing shortcomings and limitations but also improving the legal framework up to international standards.

Secondly, the revision of the enterprise law is carried out with the best regional and international standards and practices taken into account as both measuring indexes and targets. The explanatory report submitted together with the bill to the National Assembly clearly states: “The overall objective [of the revision of the Enterprise Law] is to improve the legal framework on corporate governance up to good and common practices in the region and the world.” In light of this, the mechanism for protection of lawful rights and interests of investors, shareholders and members of enterprises is further improved, striving to increase the country’s ranking in the World Bank’s Strength of Investor Protection index by at least 20 grades.

|

Producing garments at Tien Hung Garment Joint-Stock Company in Hung Yen province__Photo: VNA |

Further facilitating market entry

Market entry can be understood as the whole process from the time an investor proceeds with necessary procedures for establishment of an enterprise till it/he/she can start doing business. Compared to other countries in the region and the world, procedures for starting a business in Vietnam are more complicated, costly and time-consuming. At present, Vietnam ranks 114th among 190 economies in the World Bank’s Starting a Business index. This situation gives rise to a need for strong reform of administrative procedures, thus shortening time and cutting costs for market entry. Obviously, such a comprehensive reform requires the revision of not only the enterprise law but also regulations on tax, labor, etc. Let’s see how the 2020 Law deals with this matter.

The most noticeable change in the 2020 Law is the abolishment of superfluous regulations such as the requirement on notification of enterprises’ seal specimens before use and the adoption of a mechanism for online registration of enterprises. This is expected to take Vietnam one step closer to the goal of facilitating enterprise establishment and registration, cutting costs and time required for starting a business and thereby, raising the country’s ranking in the Starting a Business index.

Better protecting investors and shareholders

Shareholder protection is regarded as the most important pillar of the legal framework on corporate governance. Effective and feasible shareholder protection regulations will turn enterprises into a safe tool for conducting business activities and on that basis, promote and attract investment capital. To this end, shareholder protection mechanisms must adhere to the principles of ensuring equal treatment among shareholders; preventing major shareholders or company managers from appropriating lawful rights and interests of minor shareholders; effectively controlling conflicts of interest; and enabling shareholders to sue company managers for breaches of responsibilities in company administration.

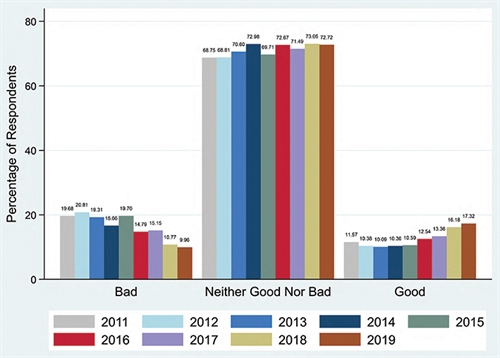

Vietnam’s regulations on investor protection have been remarkably improved over the past few years. In 2013, Vietnam was ranked 169th among 190 economies in the World Bank’s Protecting Minority Investors index and managed to jump to the 117th position in 2014 and the 97th place in 2019. However, Vietnam was still left far behind regional countries. Indonesia, the country most similar to Vietnam, was ranked 51st while Thailand, Singapore and Malaysia were placed at much higher positions of 15th, 7th and 2nd, respectively. (See Table 1)

Table 1: Protecting Minority Investors index, compared between Vietnam and some Asian countries

Source: World Bank: Doing business Report 2019

Designed with a view to improving the country’s corporate governance framework up to the best practices in the region and the world, the 2020 Law introduces a number of fundamental changes such as broadening the extent and scope of rights of shareholders, thus creating favorable conditions for shareholders to protect their lawful interests; extending shareholders’ right to access to information on operations of companies; and enabling shareholders to initiate lawsuits against company managers in case the latter abuse their positions and powers, causing damage to the companies or shareholders.

Specifically, the 2020 Law also abandons or reduces conditions for shareholders to exercise such rights as the right to nomination or the right to access to information on companies’ business situation.

For example, the 2020 Law abolishes the requirement in the 2014 Enterprise Law stating that a shareholder or a group of shareholders must own shares for at least six consecutive months and, at the same time, halves the required minimum shareholding rate from 10 percent to 5 percent. The new Law also adds a regulation empowering shareholders to request courts to force companies to provide information necessary for the initiation of lawsuits against company managers. In addition, the 2020 Law no longer requires companies to form a Supervisory Board but allows companies to select a governance and supervision model suitable to their operation and international practices.

Improving governance and operational effectiveness of state enterprises

Restructuring, renewing and improving operational effectiveness of state-owned enterprises (SOEs) are major policies of the Vietnamese Party and Government. The Party Central Committee’s Resolution 12-NQ/TW of 2017 clearly identifies the viewpoints that SOEs operate under the market economy mechanism with economic efficiency considered the main criterion for these enterprises to be assessed, enjoy autonomy, take self-responsibility and compete on an equal footing with enterprises of other economic sectors in accordance with law.

In order to ensure publicity, transparency and accountability of SOEs, the 2020 Law makes several noteworthy changes in regulations on SOEs, e.g., enhancing the control over centralization of powers and conflicts of interest, further transparentizing operations of SOEs, and adding regulations on publicization of information of enterprises, etc.

Boosting the development of the capital market

In order to lure more investment capital for production and business activities, the 2020 Law adds regulations on non-voting depositary receipts (NVDRs). Accordingly, companies that wish to issue NVDRs will deposit a certain volume of ordinary shares which will be used as underlying assets. NVRD holders do not have voting rights but are entitled to all economic benefits as well as rights and obligations corresponding to underlying ordinary shares.

The grant of permission for issuance of NVRDs will diversify products traded in the securities market and, at the same time, help enterprises, especially those operating in fields subject to foreign ownership restrictions, get greater chances to attract capital from investors, including also foreign ones. In these cases, the objectives of state management can still be ensured while enterprises are provided with an effective tool for raising capital. Hence, directly or indirectly, the revision of the enterprise law will have great impacts on the capital market and offer enterprises great chances to mobilize investment capital from sources other than the traditional source of credit institutions. However, it is not redundant to say that the role of law is to create favorable environment and opportunities for enterprises but the seizure of these opportunities depends on enterprises.

Easing acquisition and merger activities

The 2020 Law also contains several new regulations which are designed to remove current shortcomings and limitations in regulations governing acquisition and merger activities. For example, while the current law says that private enterprises can only be transformed into limited liability companies, the new Law also permits the transformation of private enterprises into joint-stock companies.

The 2020 Law will come into force on January 1 next year.-