|

| Photo: https://vtcnews.vn |

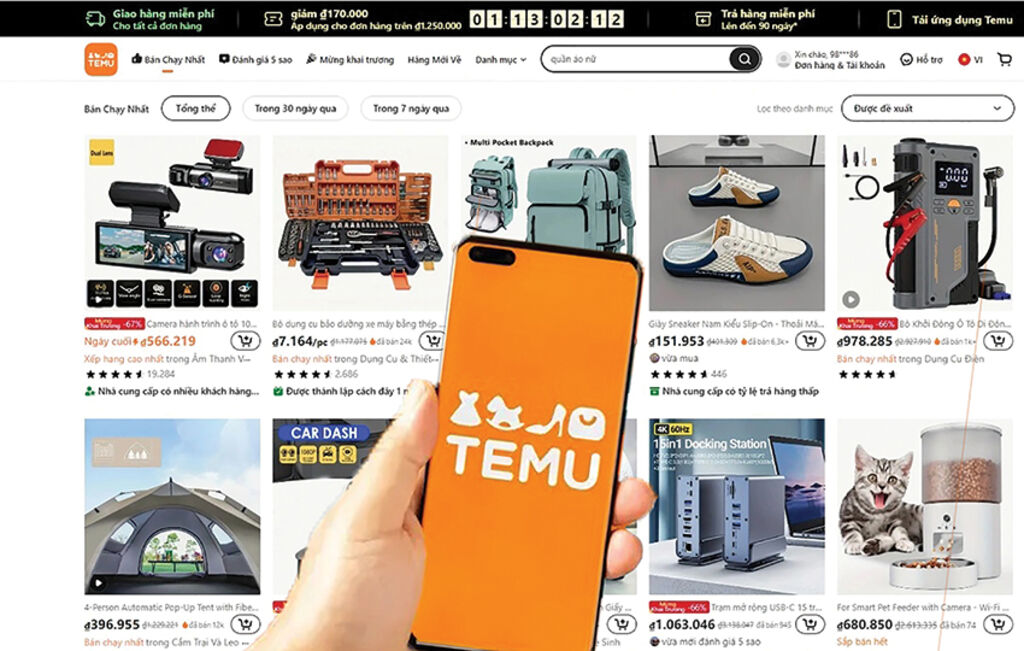

In late September, Temu, an e-commerce platform belonging to the Chinese PDD Holdings, started allowing users in Vietnam to shop and make payment directly on the platform, using Vietnamese language.

Operating under the motto “Shop like a billionaire,” Temu is well-known for offering products at low prices, sometimes unbelievably cheap. Temu’s products are very diverse, ranging from household appliances, furniture to fashion items and technology equipment, etc.

However, it is revealed that Temu has yet to register its operation with the Vietnamese authorities. More than a month after its launch, on October 24, Temu filed an official document to the Ministry of Industry and Trade (MOIT) to notify the latter of its intention to enter the market.

Sooner or later, once Temu goes through all procedures as prescribed by Vietnam’s law, it will probably get a license for official operation in the country. But even after Temu is licensed, the appearance of Temu and similar platforms like Shein, 1688, Taobao, etc., in the domestic online retail market gives rise to many questions about management of cross-border e-commerce activities.

Concerns about unfair competition

“Competition is inevitable, but the most frightening thing is having to compete on a playing field which is unfair to businesses that well observe Vietnam’s law.”

This is the comment of the representative of a local e-commerce platform quoted by public policy expert Hung Pham in an article published on the Goc nhin (Perspectives) column of the VnExpress.

In his article, Hung Pham pointed out several inequalities facing Vietnam-based e-commerce enterprises in the competition with their rivals across the border.

The first challenge lies right in the process of licensing. According to Government Decree 52/2013/ND-CP on e-commerce activities, if wishing to establish and operate e-commerce platforms in Vietnam, enterprises, both local and foreign-invested, have to apply for a specialized license. Particularly, foreign-invested businesses are also required to obtain a license for goods trading activities under Government Decree 09/2018/ND-CP detailing the Commercial Law and the Law on Foreign Trade Management regarding goods trading and related activities of foreign investors and foreign-invested economic organizations in Vietnam.

However, “licensing is just the beginning,” Hung Pham wrote. E-commerce platforms establishing domestic legal persons are subject to more obligations than cross-border ones. Decree 52/2013/ND-CP, revised by Decree 85/2021/ND-CP, imposes 21 obligations on domestic e-commerce platform operators. As for cross-border platform businesses, this number is just three. It is not to mention illegal platforms that do not have to comply with any obligations.

Secondly, it is the current tax policy that gives cross-border e-commerce platforms a comparative advantage in price competition over domestic ones. Under the current tax law, almost imports are now liable to value-added tax at the rate of 10 percent and an import duty rate of up to tens of percent. However, as stated in Prime Minister Decision 78/2010/QD-TTg, shipments valued at under 1 million Vietnam dong and sent via express mail services are exempt from import duty and value-added tax. Given the fact that most e-commerce orders are of small value, ranging between a few tens of thousands to few hundreds of thousands Vietnam dong, this is not a small advantage.

Another issue that needs to be taken into consideration is product quality. Normally, before being imported, goods that pose a safety risk, also known as group-2 goods, must undergo an inspection process to ensure that they conform with technical standards. However, as foreign goods purchased via e-commerce channels are often of small value, they are exempt from this obligation.

In addition, many goods are imported into the country via e-commerce platforms without going through licensing process or pre-licensing inspection process. For example, while domestic cosmetics are subject to ingredient testing and imported cosmetics must have a certificate of free sale, some foreign-labeled cosmetics that do not comply with these requirements are still sold directly to Vietnamese consumers via e-commerce platforms.

The public policy expert went on to mention his concern about inequalities in law enforcement. For instance, the Ministry of Finance is proposing e-commerce platforms operating in the country to declare and pay taxes on behalf of sellers. The question here is how can we force cross-border businesses to comply with such regulation? If they delay tax payment for just one year, they will gain tens of billions of Vietnam dong.

The development of the Internet has posed great challenges to traditional management approaches. Foreign enterprises now do not need to be present in Vietnam but can still provide services to consumers in the country. “Regulations and management methods should, therefore, be changed to ensure a fair, healthy business environment to support enterprises, especially foreign-invested ones. Only then will investors have the motivation to penetrate into the market, set up businesses, and contribute to the country’s economic development,” Hung Pham stressed.

Measures to be taken in the coming time

The MOIT, in the capacity of the domestic market watchdog, has proposed to the Prime Minister several solutions for strengthening the state management of e-commerce activities, including formulating and promulgating a specialized law on e-commerce and adjusting the duty-free threshold for goods imported via express mail services provided in Decision 78/2010/QD-TTg.

The ministry has also assigned several tasks to its functional units.

Specifically, the Vietnam E-Commerce and Digital Economy Agency is requested to draw a plan on supervision and management of imported goods sold via unregistered e-commerce platforms. The Vietnam Directorate of Market Surveillance is asked to join hands with the General Department of Vietnam Customs to detect and handle warehouses of unregistered cross-border e-commerce platforms. The Agency of Foreign Trade is tasked to study measures for controlling goods imported into Vietnam via e-commerce channels.

At the same time, the Domestic Market Department is assigned to assess the impacts of goods imported via cross-border e-commerce platforms on the domestic market. The Department of Science and Technology is required to formulate standards and technical regulations applicable to goods items subject to specialized management by the MOIT. The Vietnam Trade Promotion Agency will have to raise measures to handle sales promotions which are not compliant with regulations.

Meanwhile, the National Competition Commission will enhance the protection of consumer rights in the cyberspace and carry out public communication campaigns to raise awareness about risks that might occur when consumers purchase goods on cross-border e-commerce platforms.

Back to the case of Temu, the MOIT affirmed that the platform must abide by Vietnam’s law, otherwise it will be removed.

According to current regulations, cross-border online retail platforms bearing Vietnamese domain names, displaying Vietnamese language, or having more than 100,000 transactions per year from Vietnam must register their operation with the MOIT.- (VLLF)