Nguyen Van Phung, Senior Expert

Director of the Large Taxpayers Department General Department of Taxation

In 2015, Vietnam’s economy is predicted to see signs of recovery but still face many difficulties and challenges and the country must prepare for the conclusion of negotiations on the Trans-Pacific Partnership (TPP) Agreement. In this context, Vietnam’s tax system is experiencing relatively significant changes. The state budget is facing huge pressure of two-sided tax adjustment: rapidly cutting taxes on imports to open the market and reducing domestic tax burdens for vulnerable sectors in the integration process and for goods and production and business fields where the country possesses advantages or which it needs to encourage.

At its session held late 2014, the Vietnamese National Assembly passed many important amendments to special consumption tax, value-added tax, corporate income tax, personal income tax and royalty tax and tax administration laws. For taxes levied on imports and exports, the adjustment of the import and export tariffs as well as reduction of tax rates in line with the free trade agreements (FTAs) fall under the jurisdiction of the Ministry of Finance after obtaining government approval.

This article highlights key changes in major taxes.

|

| Locals pay registration fee at Lang Son city’s Tax Department__Photo: Hoang Hung/VNA |

Taxes on imports and exports

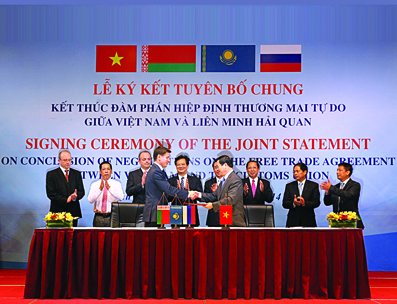

The Prime Minister has recently instructed the Ministry of Finance and related ministries and sectors to seriously implement Vietnam’s import duty commitments in FTAs during 2015-18. In addition to the Agreement on Accession to the World Trade Organization (WTO), the country has concluded seven agreements on free trade areas, including the ASEAN free trade area (AFTA); the ASEAN-China free trade area (ACFTA), the ASEAN-Republic of Korea free trade area (AKFTA), the ASEAN-Japan free trade area (AJFTA), the Vietnam-Japan economic partnership agreement (VJEPA), the ASEAN-Australia-New Zealand free trade area (AANZFTA), the ASEAN-India free trade area (AIFTA) and the Vietnam-Chile free trade area (CVFTA)...