Hundreds of representatives of southern enterprises, business associations and warehousing and port service businesses contributed their opinions to a draft circular amending and supplementing the Ministry of Finance’s Circular No. 38/2015/TT-BTC and another circular on inspection and certification of origin of imports and exports at a seminar in Ho Chi Minh City on March 15.

Deputy Director General of the Vietnam Customs Hoang Viet Cuong said the revision of Circular No. 38 dated March 25, 2015, on customs procedures, customs supervision and inspection, import and export duties, and tax administration applicable to imports and exports, was intended to further facilitate the business community, shorten the customs clearance time, apply information technology to the customs management and ensure the state management agencies’ strict control.

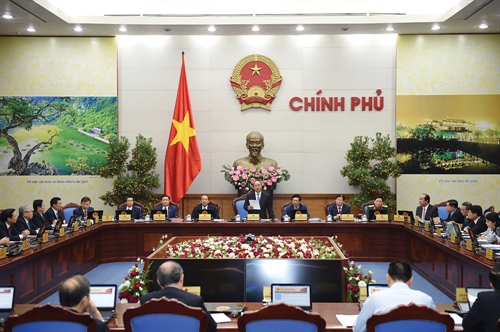

|

| Enterprises' opinions collected to revise the Finance Ministry's Circular No. 38__Photo: Internet |

Expert from USAID’s Governance for Inclusive Growth (GIG) Program in Vietnam Pham Thanh Binh highlighted the addition of regulations on the time for channeling goods which, he said, would help clear the customs procedures for the goods before their arrival at Vietnamese ports.

It was necessary to review the provisions on the time for channeling goods; customs clearance and release of goods and the submission of certificates of origin (C/O), they said.

Earlier, at a similar seminar in Hanoi on March 10, a Vietnam private sector forum (VPSF) representative suggested customs offices classify enterprises and strictly sanction violators, emphasizing the necessity to review regulations to ensure simple administrative procedures and avoid unnecessary ones.

A GIG program expert proposed to prescribe the time and conditions for declarants to make additional declarations before the customs office examines customs dossiers.

Other enterprises underlined the need to expressly prescribe the mechanism and time limit to give feedback on information declared by businesses in their customs declaration forms to satisfy business requirements.-(VLLF)